Coverage and price before brand for health plan shoppers

When Americans shop for health insurance (and they do – more, later in the post), they look most for covering major medical expenses, prescription drugs, preventive care, and price. Less important is the brand of the plan, or its high ratings. Valence Health surveyed 524 U.S. consumers in June 2015 to learn how healthcare shoppers feel about health insurance and health reform. The results are published in the report, U.S. Attitudes Toward Health Insurance and Healthcare Reform in August 2015. Key findings in the study were that: Price and coverage come before all other factors in evaluating health plans 73%

Pocketbook Health Economics In One Chart

Covering the uninsured changes pocketbook problems, this chart demonstrates. The Kaiser Family Foundation (KFF) surveyed Californians between February and May 2015, and found that people newly enrolling in health insurance had less financial stress, and more health needs met. KFF asked previously uninsured Californians to rank five household “pocketbook” spending categories which they said were difficult to afford: health care, housing (rent/mortgage), gasoline, utilities, and food. Among the five, people gaining insurance worried much less about health care costs (49%, slipping to fourth place), and more about paying for shelter (58%), utility bills (54%), and gas (53%), shown in the

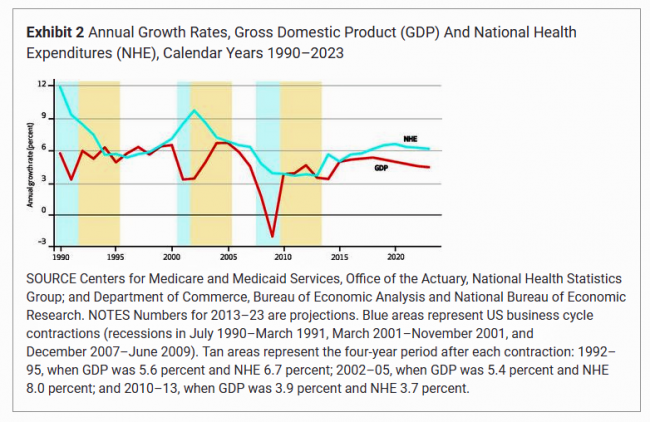

Medicare Makes the Case for Outcomes, As Increasing Costs Loom

Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential. Health Affairs provides the big economic story played out by the forecasts of the Centers for Medicare and Medicaid Services (CMS) in National Health Expenditure Projections, 2014-24: Spending Growth Faster Than Recent Trends. The topline of the forecast is that health spending growth in the U.S. will annually average

Collaboration in health/care drives value – in & beyond bio/pharma

“Tomorrow [drug makers] may not get paid for the molecule, they may only get paid for the outcome,” expects Brian Niznik of Qualcomm Life. He’s quoted in a report from PwC’s Health Research Institute, 21st Century Pharmaceutical Collaboration: The Value Convergence. What Brian’s comment recognizes is the growing value-based environment for healthcare, which couples purchasers driving down drug costs via discounts and stringent formulary (approved drug list) contracts, and growing patient responsibility for paying for prescription drugs — especially financially costly for specialty drugs that are new-new molecules. But as Brian points out, if the high-cost molecule doesn’t perform as

The Internet of Things in Health: McKinsey Sees $1.6 T Value

‘Tis the summer of big, smart reports covering the Internet of Things (IoT) impact on health and fitness. Just this month, three of these missives have come to my inbox, and they all contribute sound thinking about the topic. Today, tomorrow and Friday, I’ll cover each of these here in Health Populi. We begin with McKinsey Global Institute’s The Internet of Things: Mapping the Value Beyond the Hype. [In full disclosure, I was an outside adviser to the MGI team members who focused on the human/health and fitness aspects of this report, and thank MGI for the opportunity to provide

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

Most Americans say drug prices are unreasonable and blame company profits

Three-quarters of U.S. adults say the cost of prescription drugs are unreasonable, and blame high medication prices set by profitable pharmaceutical companies according to the Kaiser Family Foundation Health Tracking Poll for June 2015. Profits made by drug companies are the #1 reason Americans cite among major factors that contribute to the price of prescription drugs (among 77% of people), followed by the cost of medical research (64%), the cost of marketing and advertising (54%), and the cost of lawsuits (49%). Regardless of the cost, 71% of people say that health insurance should “always” pay for high-cost drugs. At the same

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

Telehealth goes retail

In the past couple of weeks, a grocery store launched a telemedicine pilot, a pharmacy chain expanded telehealth to patients in 25 states, and several new virtual healthcare entrants received $millions in investments. On a parallel track, the AMA postponed dealing with medical ethics issues regarding telemedicine, the Texas Medical Association got stopped in its tracks in a case versus Teladoc, and the Centers for Medicare and Medicaid Services (CMS) issued a final rule for the Medicare Shared Savings Program that falls short of allowing Accountable Care Organizations (ACOs) to take full advantage of telehealth services. These events beg the

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

How Growing Income Inequality Hurts Everyone, and Especially Our Health

Income inequality has increased in most developed countries, and especially in the U.S., according to the OECD’s report, In It Together: Why Less Inequality Benefits All, published in May 2015. The red arrow in the first chart shows where the U.S. ranks versus other developed nations in income inequality, which is defined as the wealth gap between rich and poor people. The U.S. has the greatest income inequality in the developed world. The second chart shows data for the U.S. on benefits provided to low-wage workers (the bottom 25% of wage earners) versus high-wage workers (the top 25% of earners).

Health care costs for a family of four in the U.S. reach $24,671 in 2015

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%. Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all

Supersize Rx: the impact of specialty drug spending and Hep C in 2014

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab. Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans. The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx

Happy 25 million, MinuteClinic and CVS Health!

Call it a Silver Million Anniversary, if you will: The MinuteClinic just saw its 25 millionth patient. This is a milestone in the evolution and growth of retail health in America, a trend-marker in this growing health industry segment that will become increasingly used by consumers, patients, parents, and caregivers. CVS bought the MinuteClinic in 2006, when the organization treated seven illnesses. Today, MinuteClinic offers 65 services and vaccinations in nearly 1,000 clinics located in 31 states and Washington, DC. In addition, MinuteClinic will grow the number of clinic locations in both existing and new markets. The company will open

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

Moms are the most important social determinant of health

It’s Mother’s Day 2015, so it’s time to praise moms and their role in making health: in their families, in their communities, and long-overlooked, for themselves. Mothers play a defining role in driving health in the world. Moms may be the most important social determinant of health. The National Partnership for Women & Families advocates for the role of women in building a healthy society, broadly defined. From the womb via the Childbirth Connection and Reproductive Health through economic security (such as fair wages and paid maternity leave) and women’s ability to access health information on behalf of their families and themselves,

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Capital investments in health IT moving healthcare closer to people

In recent weeks, an enormous amount of money has been raised by organizations using information technology to move health/care to people where they live, work, and play… This prompted one questioner at the recent ANIA annual conference to ask me after my keynote speech on the new health economy, “Is the hospital going the way of the dinosaur?” Before we get to the issue of possible extinction of inpatient care, let’s start with the big picture on digital health investment for the first quarter of 2015. Some $429 mm was raised for digital health in the first quarter of 2015,

#OwnYourHealth: Health is everywhere, even underground

Living my mantra of Health is Everywhere, where we live, work, play, pray, and shop, I am always on the lookout for signs of health in my daily life. Today I’m in Washington, DC, speaking on a webinar led by the National Council on Patient Information and Education (NCPIE), discussing the findings in a survey of U.S. adults on self-care health care – my shorthand for healthcareDIY. And the hashtag for the webinar also speaks volumes: #OwnYourHealth. Here’s the link to the survey resources. On my walk from Farragut North Metro station to a nearby office where the meeting will take place,

No relief for consumers’ healthcare costs

U.S. consumers are spending $1 in every $5 dollars in the household on health care, and personal cost curves aren’t going to bend down anytime soon. Three surveys published in April confirm my financially unwell forecast for American health citizens. Kaiser Family Foundation’s April 2015 Health Tracking Poll finds most people say health care costs or going up or holding flat, shown in the first diagram from the KFF survey. U.S. adults told KFF the top health care priorities for the President and Congress should focus on health costs, such as: Making sure high-cost drugs for chronic conditions, such as HIV,

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

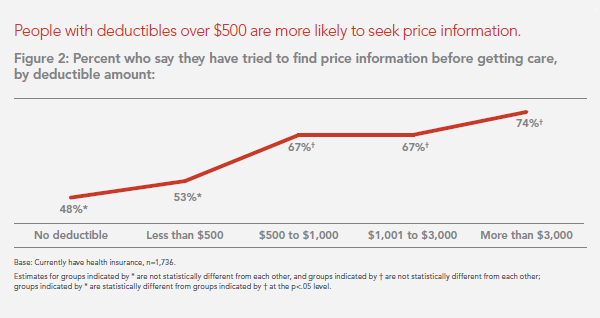

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Americans are spending $1 in $5 on health care

People in the U.S. are spending over 20.6% of their income on health care, according to data published by the U.S. Department of Commerce on March 2, 2015. This is up from 15% of personal income in 1990. Note the slope of this curve, moving up the X-Y axes from southwest to northwest. Now note the slope of the curves in the second chart, which illustrates consumer spending on other household goods and services: cars, housing, clothing, education, groceries, and eating outside of the home. Spending on these home budget line items remained relatively flat over the 25 year period 1990-2015,

Fiscal and physical fitness: TD Bank makes the link

What does a bank have to do with health? Plenty, if you listen to 70% of consumers who say that financial health has a positive impact on physical health. TD Bank released the Fiscal Fitness survey this week, finding that consumers make a direct connection between fiscal and physical fitness. That’s what we here at THINK-Health refer to as financial wellness. TD learned that 80% of consumers made a health resolution in the New Year and 69% of people made a financial resolution 40% of people want to save more and spend less, and 42% want to get healthy and

Hug your physician – chances are, s/he’s burned out

If you’re meeting with a physician in the next week or two, put on your empathy hat: chances are, they are feeling burned-out. Overall 46% of physicians report they were burned out in 2014, up from just under 40% last year. Medscape’s Physician Lifestyle Report 2015 finds that at least one-half of physicians are burned-out who work in critical care, emergency medicine, family medicine, internal medicine, general surgery, and infectious disease (including HIV). And, at least 37% of physicians are burned-out working in all other specialties, shown in the first chart. Medscape gauges doctors’ self-assessments of burnout with a lens

Telehealth is in demand, driven by consumer convenience and cost – American Well speaks

Evidence of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home. [For context, this survey defines “telehealth” as a remote consultation between doctor and patient]. Convenience drives most peoples’ interest in telehealth: saving time and money, not leaving home if feeling unwell, and “avoiding germs

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

Thinking about health disparities on Martin Luther King Day 2015

On this day celebrating Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would give two months later in Washington, DC. As I meditate on MLK, I think about health equity. By now, most rational Americans know the score on the nation’s collective health status compared to other developed countries: suffice it to say, We’re Still Not #1. But underneath that statistic is a further sad state of health affairs: that people of color in the U.S. have lower quality of

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Health and wellness at CES 2015 – trend-weaving the big ideas

Health is where we live, work, play and pray — my and others’ mantra if we want to truly bend (down) the cost curve and improve medical outcomes. If we’re serious about achieving the Triple Aim — improving public health, lowering spending, and enhancing the patient/health consumer experience (which can drive activation and ongoing engagement) — then you see health everywhere at the 2015 Consumer Electronics Show in Las Vegas this week. With this post, I’ll share with you the major themes I’m seeing at #CES2015 related to health, wellness, and DIYing medical care at home. The meta: from health care to self-care.

Trend-weaving the 2015 health care trends

‘Tis the season for annual health trendcasting, which is part of my own business model. Here’s a curated list of some of my favorite trend reports for health care in the new year, with my Hot Points in the conclusion, below, summarizing the most salient trends among them. TechCrunch’s Top 5 Healthcare Predictions for 2015: In this succinct forecast, Walmart grows its presence as a health plan, startups get more pharm-funding, hospitals channel peer-to-peer lending, Latinos emerge as a “most-desired” health care segment, and Amazon disrupts the medical supply chain. Experian 2015 Data Breach Forecast: Healthcare security breaches will be

Self-care is the new black in health care

Consumers’ growing health care cost burden is competing with other household spending: basic costs for Americans are eroding what’s left of the traditionally-defined Middle Class. At the front end of health costs is the health insurance premium, the largest single line item for a family. It looks like a big number because it is: Milliman gauged the cost for an employer to cover a family of four in a PPO in the U.S. at around $23K, with the employee bearing an increasing percent of the premium, copays, coinsurance, and a larger deductible this year than last, on average. There are

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Pharma industry update – drug spending, R&D costs, generics, and Botox

The U.S. leads in pharmaceutical drug spending. Global growth in pharmaceuticals will spike in 2014, according to the IMS Institute on Healthcare Informatics report on global pharma spending. The U.S. spends more per capita (per person) than any nation in the study, at about $1400 US dollars expected in pharmaceutical spending in 2018, owing to fewer patent expiries (the end, for now, of the patent cliff) and rising prices (think: specialty drugs like Sovaldi and oncology drugs). The next-biggest spender on Rx will be Japan, at just over $800 per person in pharmaceutical spending in 2018. The “EU5” (UK, Germany, France, Italy

Digital and mobile health: can doctors and consumers get on the same wavelength?

There’s growing interest among both consumers and clinicians in people DIY’ing healthcare. Consumers are even keener than their doctors about the self-care concept, PwC’s Health Research Institute has found. Doctors who are already in value-based payment mode — participating in accountable care organizations, at-risk for reimbursement, doing population health — are earlier adopters of digital health tools that enable patients to care for themselves outside of the health care setting. These providers are also working more on care teams, where physicians can work at their ‘highest and best use,’ complemented by nurse practitioners, physician assistants, diabetes educators, and other ancillary

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Health-committed consumers look to food to be healthy, wealthy, and wise

There’s an emerging health-committed consumer, one of over 70% of people who believe they’re less healthy than the generations who came before them. 9 in 10 consumers overall believe that what you eat impacts how you feel. Those who are health-committed spend 70% of their grocery budgets on healthy products, read food labels, spend more and shop more frequently than low health-committed consumers, according to Healthy, Wealthy, & Wise, a survey report from Dunnhumby. The number of health-committed consumers globally grew by 38% since 2009. Most consumers look first to themselves to drive health, then to doctors, and third to food companies

Health Care in the 2014 Mid-Term Election

In the November 2014 mid-term elections, Democrats tend to favor continuing the Affordable Care Act (ACA) as-is, and Republicans favor scrapping it, scaling it back, or fully replacing the law with something yet to be defined. But it’s hard to read just where the ACA will end up after tomorrow’s election, because many key battleground states are too close to call…and the two major parties have such polar views on health reform. What’s most significant this year is that those most likely to vote are less likely to vote for a congressional candidate who supports the ACA (40%) than would

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health care as a retail business

The health care industry is undergoing a retail transformation, according to Retail Reigns in Health Care: The rise of consumer power and its organization & workforce implications from Deloitte. Deloitte’s report published in October 2014 focuses on the health insurance business, which is newly-dealing with uninsured people largely unfamiliar with how to evaluate health plan options. This by any definition requires new muscles for both buyers and sellers on a health insurance exchange: new product access + uninformed consumer = retail challenge. Deloitte notes another supply and demand challenge, and that’s with the health insurance company workforce: while 93% of health

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

From comprehensive coverage to skin-in-the-game healthcare: Kaiser Family Foundation’s annual survey

For employer-sponsored health care, trends continue for health premium costs to increase, high-deductible health plans to gain adoption, and cost-sharing to shift to workers in companies’ health plans. This is the top-line of the just-released Kaiser Family Foundation (KFF) 2014 Employer Health Benefits Survey, the annual go-to resource on company-sponsored health care trends and realities. As the Kaiser Family Foundation team said during their teleconference to health writers this morning, employer-sponsored health care in America is moving “from comprehensive coverage to skin-in-the-game coverage.” The extent of said skin-in-the-game varies from small to large firms: in small companies (defined in this

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health on the 2014 Gartner Hype Cycle

Remote health monitoring is in the Trough of Disillusionment. Wearables are at the Peak of Inflated Expectations, with Big Data leapfrogging wearables from the 2013 forecast — both descending toward the Disillusionment Trough. Mobile (remote) health monitoring, however, has fallen into that Trough of Disillusionment as RHM has been undergoing reality checks in the health care system especially for monitoring and patient self-management of heart disease (most notably heart failure) and diabetes. Welcome to the 2014 edition of the Gartner Hype Cycle, one of my most-trusted data sources for doing health industry forecasts in my advisory work. Compared with last year’s

NephCure – a rare disease community that’s patient-powered

The burden of chronic kidney disease (CKD) is growing, with one in 10 U.S. adults having some level of CKD. End-stage renal disease (ESRD) is the last phase of CKD, when dialysis or an organ transplant are required. Nephrotic syndrome is one of the most common forms of CKD, and focal segmental glomerulosclerosis — FSGS — is the fastest-growing cause of nephrotic syndrome in children, and the second-leading cause of kidney failure in children. I spoke with Gigi Peterkin, a longtime colleague of mine who has helped guide my own digital footprint in health. Gigi is Global Director of Marketing at

Understanding the patient journey – using real-world data

It’s de rigueur for any organization marketing a product or service in health care to be “patient-centered” these days. “Patient engagement” and “health engagement” are phrases found on health conference agendas, whether pitching to attendees in pharma and life sciences, health IT, health insurance, or healthcare (to hospitals and physicians, alike). One paradigm for patient-centricity that’s more mature than most is IMS Health’s Patient Journey construct, which the data-driven company has been talking about since 2012. While the concept focused mainly on pharmaceutical marketing and medication adherence, it’s useful for all industry segments looking to motivate behavior change in health

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Self-care – the role of OTCs for personal health financial management

Make-over your medicine cabinet. That’s a key headline for International Self-Care Day (ISD) on July 24, 2014, an initiative promoting the opportunity for people to take a greater role in their own health care and wellness. Sponsored by the Consumer Healthcare Products Association (CHPA), consumer products companies, health advocacy organizations, and legislators including John Barrow (D-GA), a co-sponsor of H.R. 2835 (aka the Restoring Access to Medications Act), the Day talked about the $102 billion savings opportunity generated through people in the U.S. taking on more self-care through using over-the-counter medicines. After the 2008 Recession hit the U.S. economy, industry analysts

Consumer healthcare spending is up, and “fun spending” is down

This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending. The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal

Big Data Come to Health Care…With Big Challenges – Health Affairs July 2014

“For Big Data, Big Questions Remain,” an article by Dawn Falk in the July 2014 issue of Health Affairs, captures the theme of the entire journal this month. That’s because, for every opportunity described in each expert’s view, there are also obstacles, challenges, and wild cards that impede the universal scaling of Big Data in the current U.S. healthcare and policy landscape. What is Big Data, anyway? It’s a moving target, Falk says: computing power is getting increasingly powerful (a la Moore’s Law), simpler and cheaper. At the same time, the amount of information applicable to health and health care

Stress Is US

“Reality is the leading cause of stress among those in touch with it,” Lily Tomlin once quipped. Perhaps in 2014, America is the land of stress because we’re all so in touch with reality. THINK: reality TV, social networks as the new confessional, news channeling 24×7, and a world of too much TMI. So no surprise, then, that one-half of the people in the U.S. have had a major stressful event or experience in the last year. And health tops the list of stressful events in This American Life in the forms of illness and disease (among 27% of people)

Health consumers – largely in charge, engaged and cost conscious

3 in 5 people in the U.S. would like to take the lead on making medical decisions for themselves, according to the Altarum Institute Survey of Consumer Health Care Opinions, Spring 2014 edition, published July 2014. Another 30% of people want to make a joint decision with equal input from their doctor. Together, the math calculates to 9 in 10 Americans seeking major roles in medical decisions. Altarum’s survey paints a picture of consumers looking to take charge in health care, seeking information about symptoms and clinical issues. 7 in 10 people look up health information before seeing their doctor,

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

World No Tobacco Day v2014 – let’s raise (more) taxes on tobacco

Tomorrow is World No Tobacco Day. The use of tobacco is one of the most preventable public health issues on the planet. And the global tobacco epidemic contributed to 100 million deaths around the world in the 20th century. 6 million people die every year due to tobacco use — including 600,000 deaths due to exposure to secondhand smoke. About 500 million people living today will be dead from the use of tobacco products if current smoking habits continue, the World Health Organization (WHO) expects. WHO sponsors the World No Tobacco Day every year on May 31. For this year’s

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Human capital is health capital – RIP Gary Becker

“Economy is the art of making the most of life,” Gary Becker said. This Big Thinker in economics has died, and he helped shape how economists – and specifically health economists – view the world. Gary Becker was an economist who lived and thought about the real world: how we earn money, how we learn, how we live, and how our local environment impacts us. He taught at the University of Chicago, but lectured around the world. I was fortunate enough to meet him, twice, and attend his talks. While as an economist, he was masterful with numbers, he complemented

The retailization of digital health: Consumer Electronics Association mainstreams health

The Consumer Electronics Association (CEA) has formed a new Health and Fitness Technology Division, signalling the growing-up and mainstreaming of digital health in everyday life. The CEA represents companies that design, manufacture and market goods for people who pay for stuff that plugs into electric sockets and operate on batteries — like TVs, phones, music playing and listening, kitchen appliances, electronic games, and quite prominent at the 2014 Consumer Electronics Show, e-cigarettes (rebranding “safe smoking” as “vaping” technology). In its press release announcing this news, CEA President and CEO Gary Shapiro says, “Technology innovations now offer unprecedented opportunities for consumers to

The new health economy, starring the consumer

“In the New Health Economy, ‘patients’ will be ‘consumers’ first, with both the freedom and responsibility that come with making more decisions and spending their own money.” This vision of the near-future is brought to you by the New Health Economy, a report from PwC’s Health Research Institute (HRI). The chart attests the fact that U.S. “consumers” are already spending nearly $3 trillion (with a capital “T”) on products and services that bolster personal health. This spending includes $94 billion on nutrition, $62 billion on weight loss, $59 billion on sporting goods and apparel, $45 billion on (so-called) organic and

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

The appification of health – a bullish outlook from Mobiquity

Over half of people using health and fitness apps began using them over six months ago, and one-half of these people who have downloaded health and fitness apps use them daily according to survey research summarized in the report, Get Mobile, Get Healthy: The Appification of Health and Fitness from Mobiquity. The company contracted a survey conducted among 1,000 U.S. adults in March 2014 who use or plan to use mobile apps to track health and fitness. Thus the “N” in this study was a group of people already interested in self-tracking health and not representative of the broader U.S. consumer

Consumers’ spending on medicine grows – the retailization of health care

People are spending more out of their own pockets on health care, and particularly for medications. There are two sides to the medicine-spending coin: there’s the low-end which are generic drugs, most of which carry a co-pay of $10 or less. Then there’s the high end of specialty pharmaceuticals, a fast-growing category of very expensive products for which many consumers dearly pay — if and when they choose to take their doctors’ recommendations. In Medicine use and shifting costs of healthcare, IMS Institute for Healthcare Informatics reports that while (inexpensive) generic drugs comprise 86% of prescriptions in the U.S., it’s high

Doctors become health economists

The rising costs of health care in America, and consumers’ growing cost burdens, has many impacts on the U.S. health ecosystem. In particular, patients have been self-rationing due to costs, without necessarily paying attention to quality or medical outcomes. Doctors have begun to pay more attention to costs and their impacts on patients in their practices, addressed in today’s New York Times article, Treatment costs could influence doctors’ advice to patients. Andrew Pollack writes in the Times about the morphing role of doctors, some of whom are taking on the mantle of being a “steward of society,” as characterized by

Affordable medicine: a preferred future

The price of medicines is a barrier for about one billion people on the planet, for citizens in developing countries as well as middle-class families in the richest country in the world, the United States. Today is World Health Day, when for 24 hours public health advocates (including me) are calling out key issues preventing people from fully living life. One obstacle for too many people is the cost of drugs and supplies that save lives and help people add life to years. For example, bug bites can be deadly if you’re talking about the 50% of the world’s population

The New Chief Patient Officer

There’s a new member in the C-suite in health care, and her name is the Chief Patient Officer (CPO). That new role in health-town is filled by Dr. Anne Beal, appointed by Sanofi, the global biopharma company, to fill this new job description. Here she is, shaking hands with Colin Powell in one of the many awards ceremonies where Dr. Beal’s work in public health has been lauded. But what is a CPO? Because it’s a new job, Dr. Beal can create the role, at least within the environment and mission of Sanofi and the larger life sciences world. Some

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

The new math for Rx: HSAs up, adherence down

A consumer who is faced with greater financial skin-in-the-healthcare game, cost-sharing, is expected to become a smart shopper for lower-priced health products and services. When it comes to patients given prescriptions for medicines, the theory is that patients will choose less expensive generic drugs over brand names it people think the cheaper meds are good substitutes. This is referred to as the generic-drug dispensing rate (GDR). But the theory doesn’t consistently hold true in real life, a study from the Employee Benefit Research Institute (EBRI), Brand-Name and Generic Prescription Drug Use After Adoption of a Full-Replacement, Consumer-Directed Health Plan With a

FICO scores for health – chatting with a #BigData pioneer

I had the pleasure of spending quality time brainstorming with Mikki Nasch, co-founder of AchieveMint, yesterday. Mikki worked on the early days of building the FICO score with Fair Isaac, so has been involved in Big Data well before it became the well-#hashtagged buzzword it is today. In our conversation, we talked about the history of FICO and how it took about a decade for consumers to understand it, accept it, and use it as a tool for bettering their credit ratings. When a FICO score was below an acceptable threshold to a lender – say, for a new car

People want to DIY with pharma

In our increasingly-DIY society, most consumers expect high levels of access and customer service from the organizations with whom we engage. With more consumers reaching into their pockets to pay for health services and products, the health industry is increasingly a retail-facing environment. So expect quality service levels from their healthcare touch points. The pharmaceutical and prescription drug touch point is not exempt from this expectation, as learned by an Accenture survey analyzed in Great Expectations: Why Pharma Companies Can’t Ignore Patient Services. As the first picture shows, 70% of patients think pharma companies are responsible for bundling information and services

The four futures of health care: simple, guru, ecosystem, self-care

In the not-too-distant future, will our health care be universally available to all, standardized with limited choices? Or, will we be in self-care mode, able to “buy up” if we can afford it like luxury goods? Will health care delivery be totally tech- and information-driven? Or, will care be driven by insurers’ health plans with artful designs that (almost) predetermine our choices? Welcome to four futures of health care, brought to us by PA Consulting whose report, How Can We Stop Healthcare From Bankrupting Our Children? speaks to scenarios based on 2 uncertainties, whether: Health care will be a personal

Pharma warming up to the cloud to drive efficiencies and support analytics

Over the next few years, large global pharma companies will need to wring out an additional $35 billion worth of efficiencies in order to drive profitability. While the industry has most of the patent cliff challenge behind it, companies face price constraints with respect to health reform, static national economies, and access demands. As the pharmaceutical industry enters the value-based health care era, the industry must catch up with other vertical markets in adopting information technology. In particular, pharma has been slower to migrate to the cloud than other businesses, with concerns about security and health care particular needs. Today, the

The digital health bubble – is it about to burst? #SXSW

That’s a useful and timely question, given the news that Castlight Health will launch its IPO with valuations north of $1 billion. Yes, “billions,” and according to a MarketWatch analysis, “it’s a bargain at $1 billion.” So then – do we anticipate a bubble? asked Marc Monseau of the Mint Collective, the convener of our panel who brought together Robert Stern, a successful health-tech entrepreneur whose latest venture, @PointofCare, focuses on patient engagement; Marco Smit of Next Innovation Health Partners (parting from the Health 2.0 Conference family where he led Health 2.0 Advisors for several years); and me. Some key

Risk-shift: employers continue to push more risk to employees and families for health costs

With health costs increase increasing at 4.4% in 2014, a slightly higher rate of growth than the 4.1% seen in 2013. While this is lower than the double-digit increases U.S. employers faced in 2001-2004, it’s still twice the rate of general consumer price inflation. That’s what the first graph shows, based on the The 19th Annual Towers Watson/National Business Group on Health Employer Survey on Purchasing Value in Health Care. Employers generally want to continue to provide health insurance…for the time being. 92% of companies expect to make changes in health plan provisions in 2014, with 1 in 2 anticipating “significant

HIMSS14 Monday Morning Quarterback – The Key Takeaways

Returning to terra firma following last week’s convening of the 2014 annual HIMSS conference…taking some time off for family, a funeral, the Oscars, and dealing with yet another snowstorm…I now take a fresh look back at #HIMSS14 at key messages. In random order, the syntheses are: Healthcare in America has entered an era of doing more, with less...and health information technology is a strategic investment for doing so. The operational beacon going forward is moving toward The Triple Aim: building population health, enhancing the patient’s experience, and lowering costs per patient. The CEO of Aetna, Mark Bertolini, spoke of the

Hillary Clinton wows the HIMSS14 crowd

At last year’s annual HIMSS conference, I had the pleasure of experiencing Bill Clinton’s keynote speech in New Orleans, which I wrote about here. As a long-time member of HIMSS, this was a great moment in my many years attending HIMSS conferences. Another special moment in HIMSS conference history happened today, as, I had the honor of attending Hillary Clinton’s keynote speech at HIMSS 2014 in Orlando today. I am blessed with fast-typing fingers thanks to my mother’s genes, and took constant notes during Hillary’s talk. My favorite paragraphs are quoted below, indicating “Applause” pauses where Hillary was lauded.

Patient engagement and mobile health – design and timing matter

Thinking about personal health information technology – the wearable devices, remote health monitors, digital weight scales, and Bluetooth-enabled medical equipment scaled for the home – there are two glasses. One is half-full and the other, half-empty. The half-full glass is the proliferation of consumer-facing devices like Fitbit, Jawbone and Nike, which comprise the lion’s market share in the health wearables segment; the mass adoption of mobile phones and tablets; consumers’ multi-screen media behavior (as tracked by Nielsen); and consumers’ growing share of medical spending, now about 40% of annual spending (or something north of $8,000 for a family of four

The new retail health: Bertolini of Aetna connects dots between the economy and health consumers

3 in 4 people in America will buy health care at retail with a subsidy within just a few years, according to Mark Bertolini, CEO of Aetna. Bertolini was the first keynote speaker this week at the 2014 HIMSS conference convened in Orlando. Bertolini’s message was grounded in health economics 101 (about which frequent readers of Health Populi are accustomed to hearing). A healthy community drives a healthy local economy, and healthier people are more economically satisfied, Bertolini explained. The message: health care can move from being a cost driver to being an economic engine. But getting to a healthy

Patients play a starring role at #HIMSS14 – Best In Show

Even before stepping into the Orlando Convention Center on Sunday 23 February 2014, my clairvoyant powers know the forecast of the Best in Show: the growing role of patients in health care, reflected in both the education session at the annual 2014 meeting of HIMSS as well as the product/service mix being proffered on the convention show floor. As a member of HIMSS Connected Patient Committee, I know first-hand the conscious effort and energy that the organization has committed to getting real about patients’-peoples’-caregivers’ central role in health care. The organization was built on providers and technology. When I first

Where’s TripAdvisor for health care? JAMA on physician ratings sites

As more U.S. health citizens enroll in high-deductible health plans – now representing about 30% of health-insured people in America – health plan members are being called on to play the role of consumer. Among the most important choices the health consumer makes is for a physician. Ratings sites and health care report cards ranking doctors by various characteristics have been in the market for over a decade. However, little has been known on the public’s knowledge about the availability of these information sources, nor of peoples’ use of physician rating sites. This question is addressed in Public Awareness, Perception, and

Why Health IT (Should) Matter to Consumers

This is the first of four posts that are written for the HIMSS 2014 Blog Carnival. The theme, provided by HIMSS (the Healthcare Information and Management Systems Society): “Why Health IT Matters to Consumers.” You’ll note the title here has been purposefully changed. Health IT “should” matter to consumers. Since George Bush declared in 2004 that within 10 years’ time, U.S. health citizens would each have an electronic medical record, there’s been as more bipartisan support inside the Beltway for EHRs than possibly for any other issue in Congress. The American Recovery & Reinvestment Act of 2009 (ARRA), aka the

Managing cost and utilization are top goals for specialty pharmacy buyers

While the prescription drug bill makes up about 10% of U.S. national health spending, the fastest-growing component of pharmacy spending is specialty medications. These are categorized as “specialty” drugs because they rarely have generic equivalents, and treat serious or life-threatening diseases (such as cancer, MS, and rheumatoid arthritis). They are also “special” because specialty pharmaceuticals average $3,000 per patient per month and can surpass $100,000 a year for certain products. As a result, the top two goals for managing specialty medications among employers are #1, to reduce inappropriate utilization, and #2, to reduce drug acquisition costs, based on a survey

A CT for $300 or $2,781 – why health price transparency matters

Charges for medical, pharmacy and dental services can vary by more than 300%. This means that in one place, a procedure that costs $100 can cost $300 for the same treatment in another location or practice, discovered by Change Healthcare in their latest Healthcare Transparency Index 2013 Q3 Report, published in January 2014. The 300% is the average overall across dozens of health services used by the 67,000 plan members Change Healthcare analyzed based on health plan enrollees’ health care utilization in the third quarter of 2013. These health care services include office visits (behavioral health, physical therapy and

What CVS going tobacco-free means for health and business

Bravo! to CVS/pharmacy who today announced it would pull tobacco products from store shelves by October 2014. “The sale of tobacco products is inconsistent with our purpose,” the company’s press release asserts. The move will cost CVS $1.5 billion in revenue annually, as the company seeks to consolidate its position as a health company. CVS/pharmacy is part of CVS Caremark, which includes the retail pharmacy chain (the second-largest in the U.S.), a pharmacy benefit management company (Caremark), and retail health clinics (Minute Clinics). CVS Caremark also participates in a healthy communities program issuing grants for projects that focus on health

Connected Health – the technology is ready, providers on the cusp

The convergence of technology developments – such as the internet, mobile phone adoption, cloud computing, sensors, electronic health records – with societal evolution including consumerism, demand for transparency, and “flatter” organizations – enable the phenomenon of Connected Health. Connected Health by definition includes mobile health (mHealth), telehealth and telemedicine, as presented in the February 2014 issue of Health Affairs which is dedicated to this theme. Why Connected Health’s time is Now relates to those factors cited above, and the underlying challenge of managing health care costs. While all nations in the developed world are facing difficult health economies, the U.S. spends so

U.S. families face medical financial burdens; health care in the SOTU

A growing proportion of American families are facing money problems related to health care, according to the report, Financial Burden of Medical Care: A Family Perspective, No. 142 in the NCHS Data Brief series from the CDC, published January 2014 and based on 2012 data. 1 in 4 families are dealing with some financial burden due to medical care. “Financial burdens” in health include problems paying medical bills in the past 12 months, shared by 16.5% of families; and medical bills being paid over time, faced by 21.4% of families. 1 in 10 families (9%) have medical bills they are

Pharma and the health industry: when will they finally meet us Where We Live?

Millions of health citizens, consumers, patients and caregivers flock to Facebook, Twitter and Wikipedia every day the world over to seek health information, advocate for patients’ access to a cancer therapy on a health blog, engage in peer-to-peer health care in a social network, and bolster each others’ management of chronic medical conditions in a chat community. Yet the pharmaceutical and medical device industries rank well behind other industries vis-à-vis the use of social media, asserts Engaging patients through social media, with the punchline question: is healthcare ready for empowered and digitally demanding patients? from the IMS Institute for Healthcare Informatics, published on

I'm once again pretty gobsmackingly happy to have been named a judge for

I'm once again pretty gobsmackingly happy to have been named a judge for  Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during

Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during  Jane collaborated on

Jane collaborated on