Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

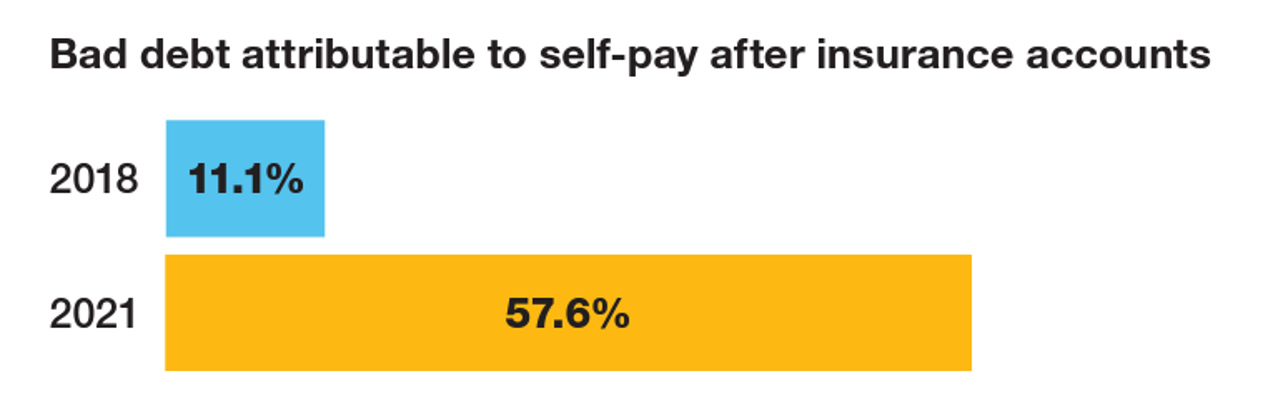

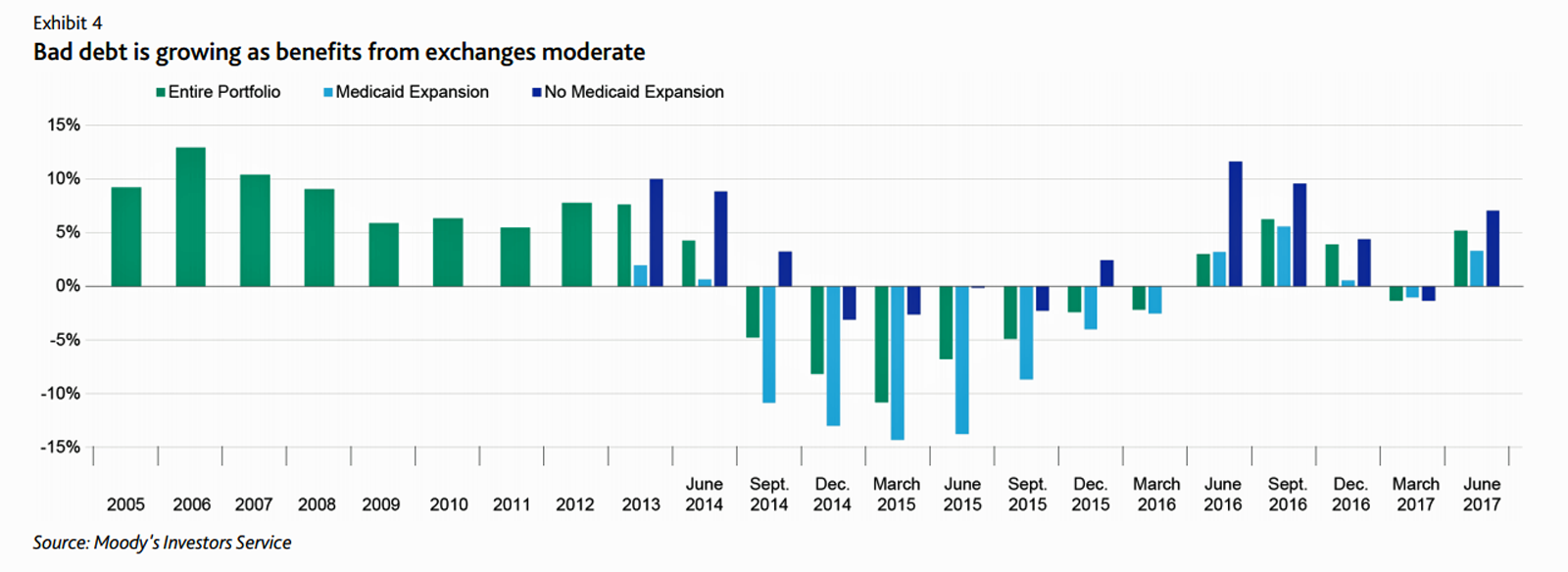

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

The Retail Health Battle Royale, Day 5 – Consumer Demands For a Health/Care Ecosystem (and What We Can Learn from Costco’s $1.50 Hot Dog)

In another factor to add into the retail health landscape, Dollar General (DG) the 80-year old retailer known for selling low-priced fast-moving consumer goods in peoples’ neighborhoods appointed a healthcare advisory panel this week. DG has been exploring its health-and-wellness offerings and has enlisted four physicians to advise the company’s strategy. One of the advisors, Dr. Von Nguyen, is the Clinical Lead of Public and Population Health at Google….tying back to yesterday’s post on Tech Giants in Healthcare. Just about one year ago, DG appointed the company’s first Chief Medical Officer, which I covered here in

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

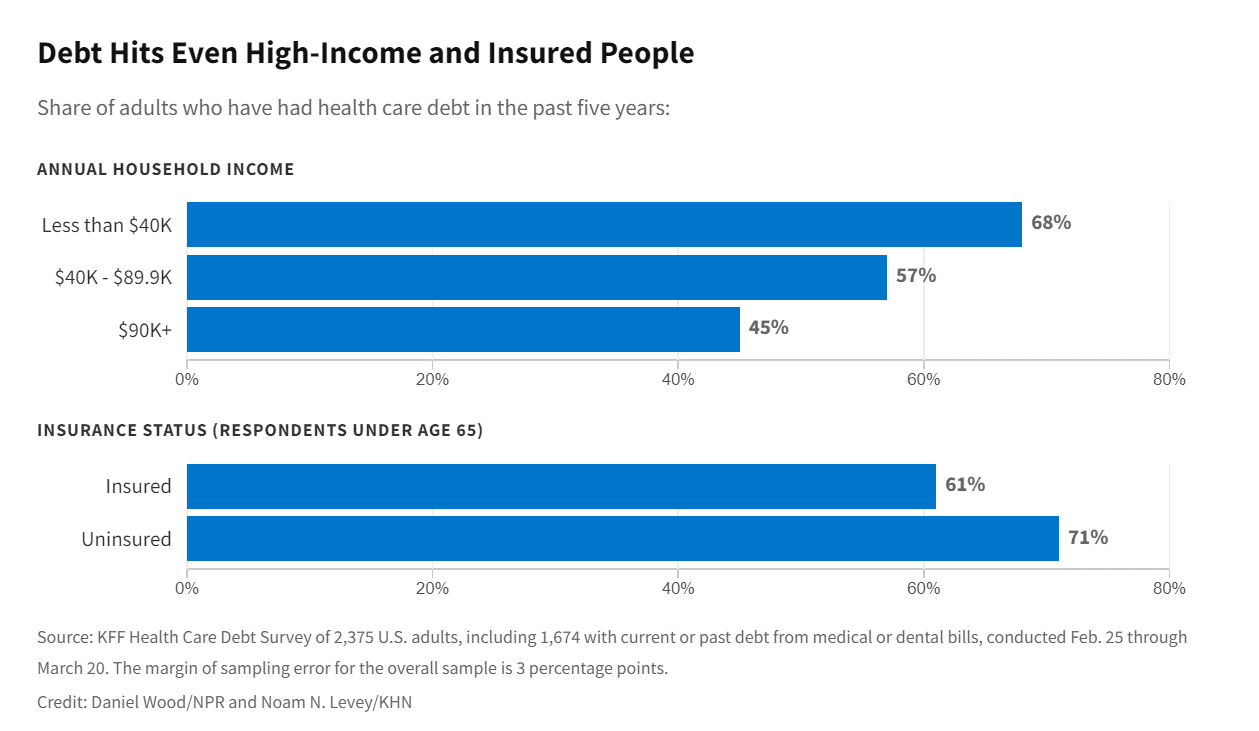

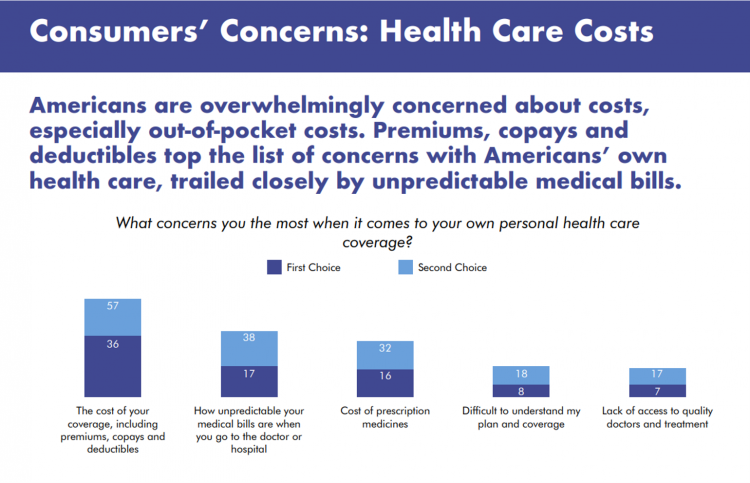

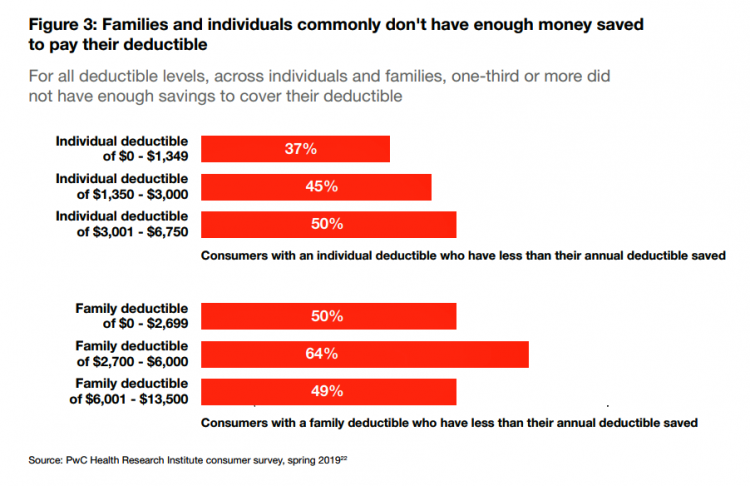

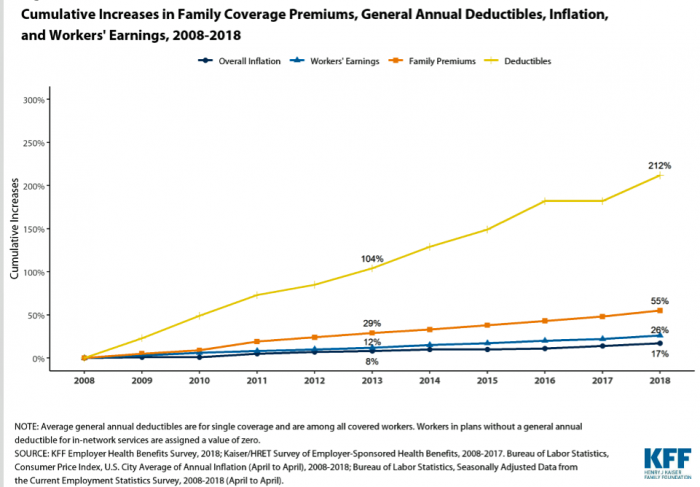

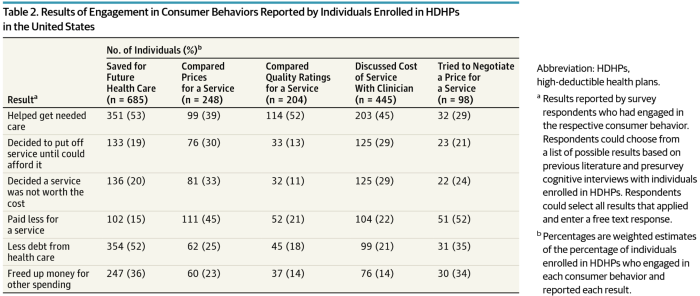

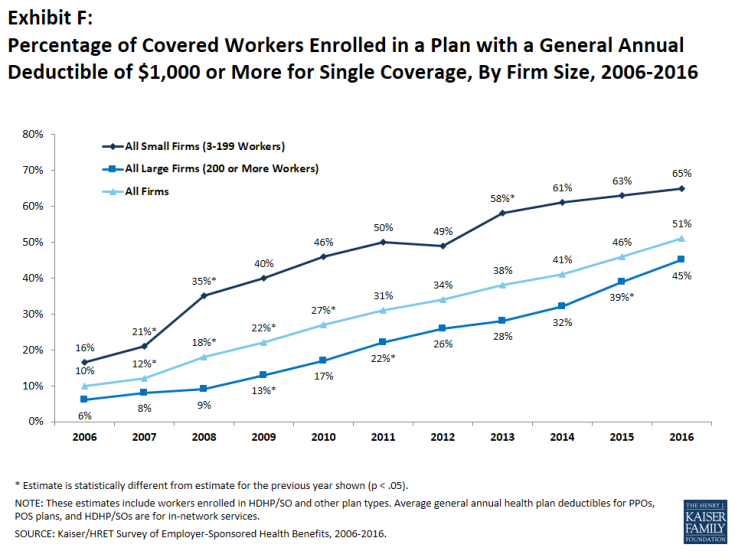

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

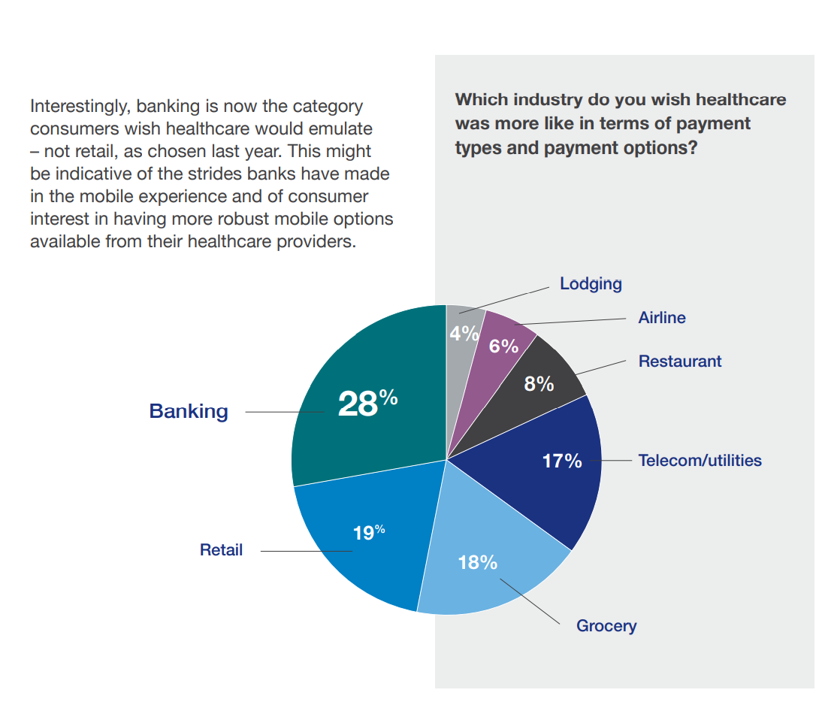

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

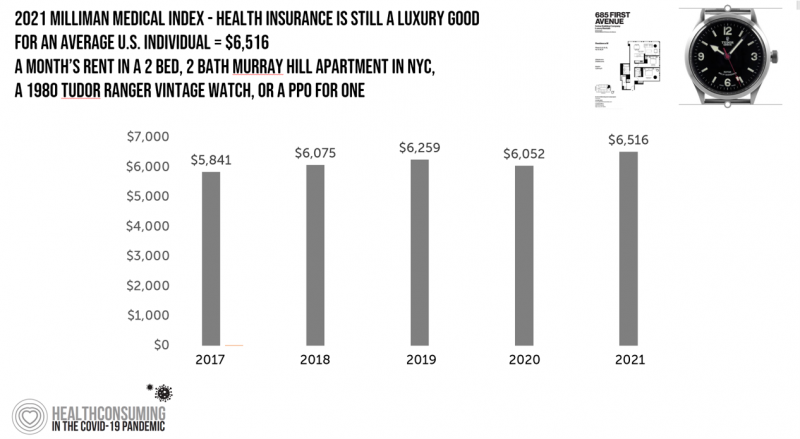

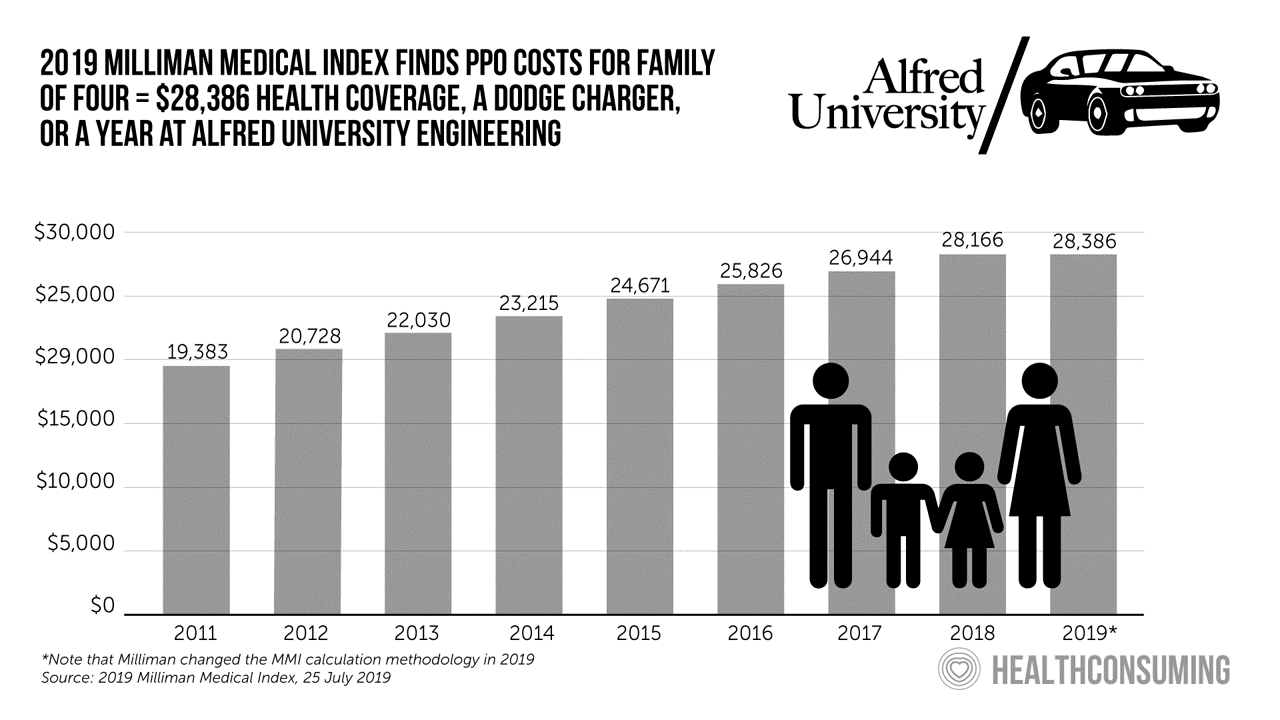

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

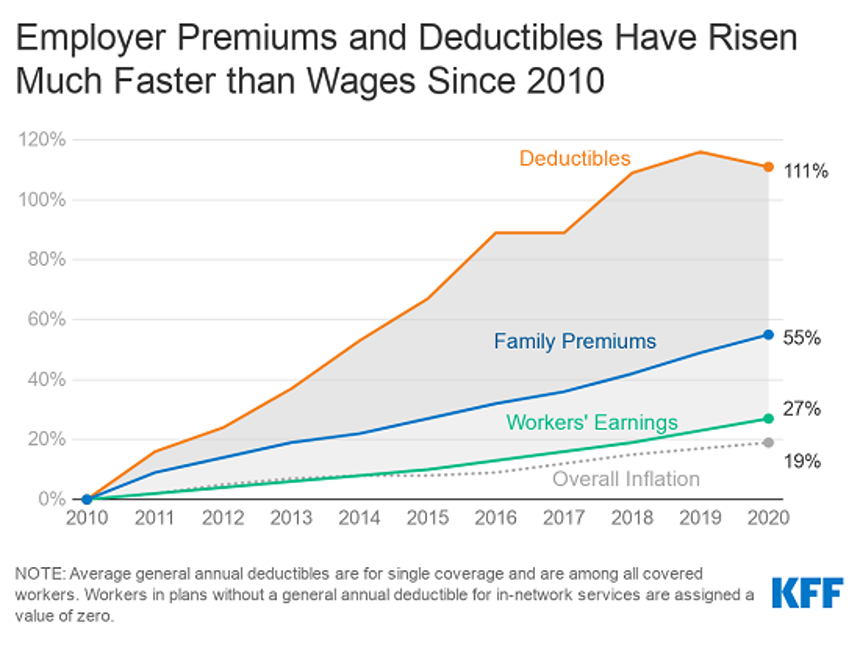

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

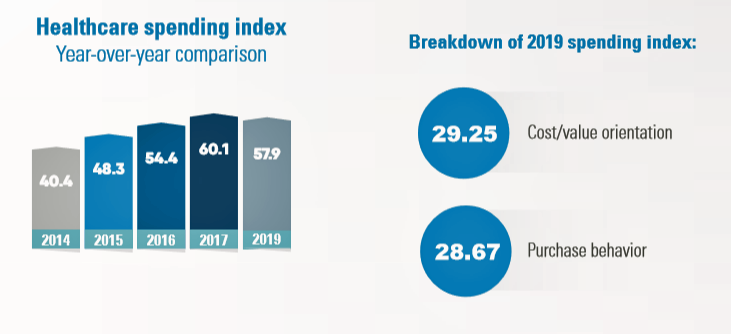

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Retail Pricing in U.S. Health Care? Why Transparency Is Hard to Do

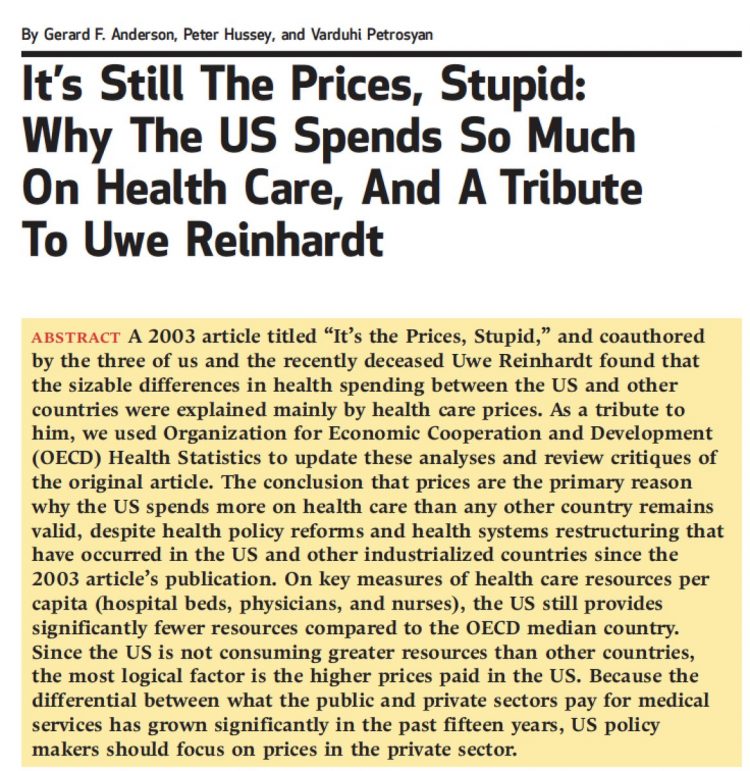

“It’s the prices stupid,” Uwe Reinhardt and Gerard Anderson and colleagues asserted in the title their seminal Health Affairs manifesto on U.S. healthcare spending. Sixteen years later, yesterday on 8th July 2019, a Federal U.S. judge blocked, in the literal last-minute, a DHHS order mandating prescription drug companies to publish “retail prices” of medicines in direct-to-consumer TV ads. I was getting this post on transparency together just before that announcement hit the press, so this post would have had a different nuance yesterday compared with today. And that’s how health care politics and economics in America roll these days. Welcome to

Prescription Drugs Are Becoming A Luxury Good in America – Join the #HCLDR Chat Tonight

“Drugmakers Push Their Prices Higher” is the top story under the Business & Finance banner in today’s Wall Street Journal. That’s in terms of drugs’ list prices, which most patients don’t pay. But drug costs to patients are in the eye of the beholder, who in a high-deductible plan or Medicare Part D donut hole becomes the first-dollar payer. Patients continue to face rising drug costs, pushing them into what I’ve been thinking about as luxury-goods territory. The economic definition of a luxury good is a product for which demand increases more than proportionally as income rises, so that spending

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

Healthcare Costs Inspire Employer Activism and Employee Dissatisfaction – What PwC Found Behind the Numbers

In the U.S. each year between 2006 and 2016, employees’ healthcare cost sharing grew 4.5%. In that decade, Americans’ median wages rose 1.8% a year, PwC notes in their annual report, Medical cost trend: Behind the numbers 2020 from the firm’s Health Research Institute. Medical cost trend is the projected percent growth in healthcare costs over a year based on an equivalent benefit package from one year to the next. As the first chart shows, trend will grow 6% from 2019 to 2020. This is an increase of 0.3 percentage points up from 5.7% for 2019, which was flat from

Prescription Drug Costs In America Through the Patient Lens, via IQVIA, GoodRx and a New $2 Million Therapy

Americans consumed 17.6 prescriptions per person in 2018, two in three of which treated chronic conditions. Welcome to Medicine Use and Spending in the U.S. , the annual review of prescription drug supply, demand and Rx pricing dynamics from the IQVIA Institute for Human Data Science. In a call with analysts this week in which I participated, the Institute’s Executive Director Murray Aitken discussed the report which looks back at 2018 and forward to 2023 with scenarios about what the U.S. prescription drug market might look like five years from now. The report is organized into four sections: medical use

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

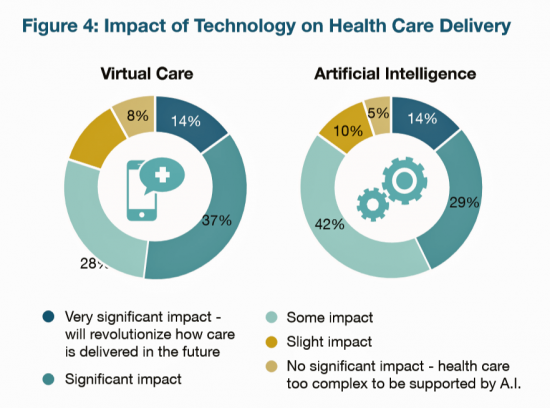

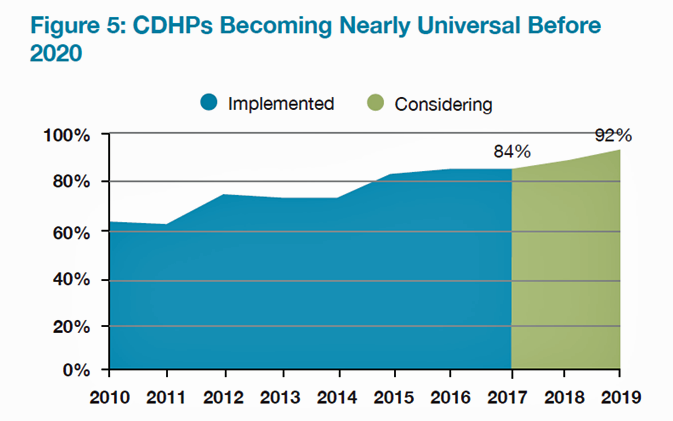

Employers Take on Health Activism, Embracing Behavioral Health, Virtual Care, AI, and Transparency

More U.S. employers are growing activist roles as stakeholders in the healthcare system, according to the 2019 Large Employers Health Care Strategy and Plan Design Survey from the National Business Group on Health (NBGH). Consider the Amazon-Berkshire Hathaway-JPMorgan Chase link up between Jeff Bezos, Warren Buffet, and Jamie Dimon, as the symbol of such employer-health activism. The NBGH report is based on survey results collected from 170 large employers representing 13 million workers and 19 million covered lives (families/dependents). This annual survey is one of the most influential such reports released each year, providing a current snapshot of large employers’ views

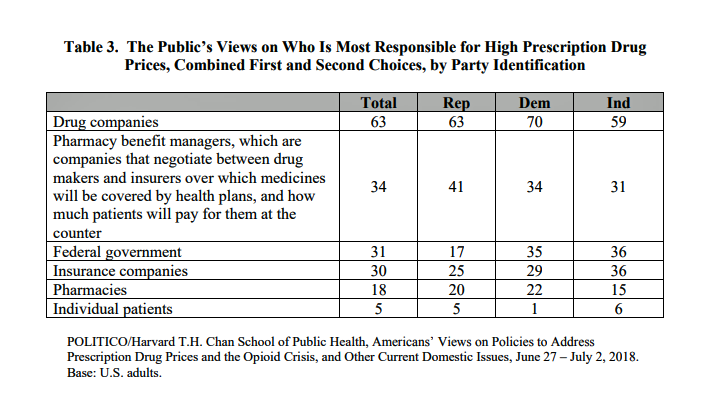

“Lower Prescription Drug Prices” – A Tri-Partisan Call Across America

There’s growing evidence that a majority of U.S. voters, across the three-party landscape, agree on two healthcare issues this year: coverage of pre-existing conditions, and lowering the consumer-facing costs of prescription drugs. A new poll jointly conducted by Politico and the Harvard Chan School of Public Health bolsters my read on the latter issue – prescription drug pricing, which has become a mass popular culture union. There may be no other issue on voters’ collective minds for the 2018 mid-term election that so unites American voters than the demand for lower-cost medicines. This is directly relates to consumers’ tri-party

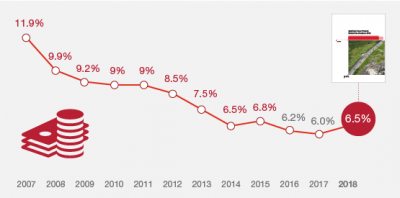

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

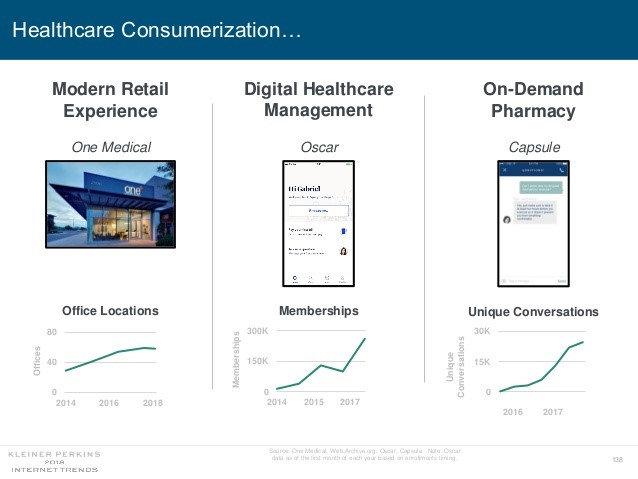

Mary Meeker on Healthcare in 2018: Connectivity, Consumerization, and Costs

Health care features prominently in the nearly-300 slides curated by Mary Meeker in her always- informative report on Internet Trends 2018. Meeker, of Kleiner Perkins, released the report as usual at the Code Conference, held this year on 30 May 2018 in Silicon Valley. I’ve mined Meeker’s report for several years here on Health Populi: 2017 – Digital healthcare at the inflection point, via Mary Meeker 2015 – Musings with Mary Meeker on the digital/health nexus 2014 – Healthcare at an inflection point: digital trends via Mary Meeker 2013 – The role of internet technologies in reducing healthcare costs – Meeker

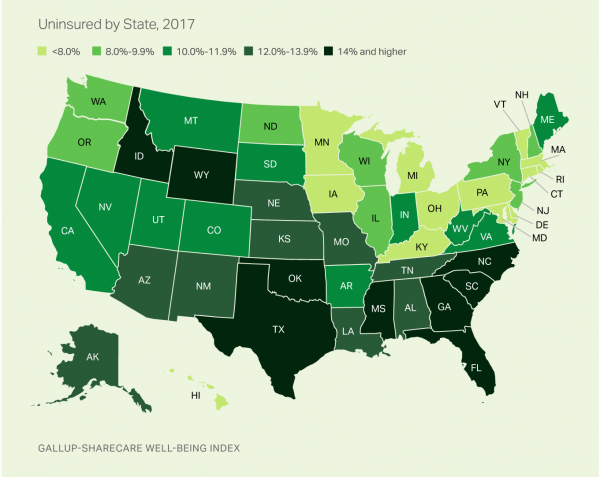

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

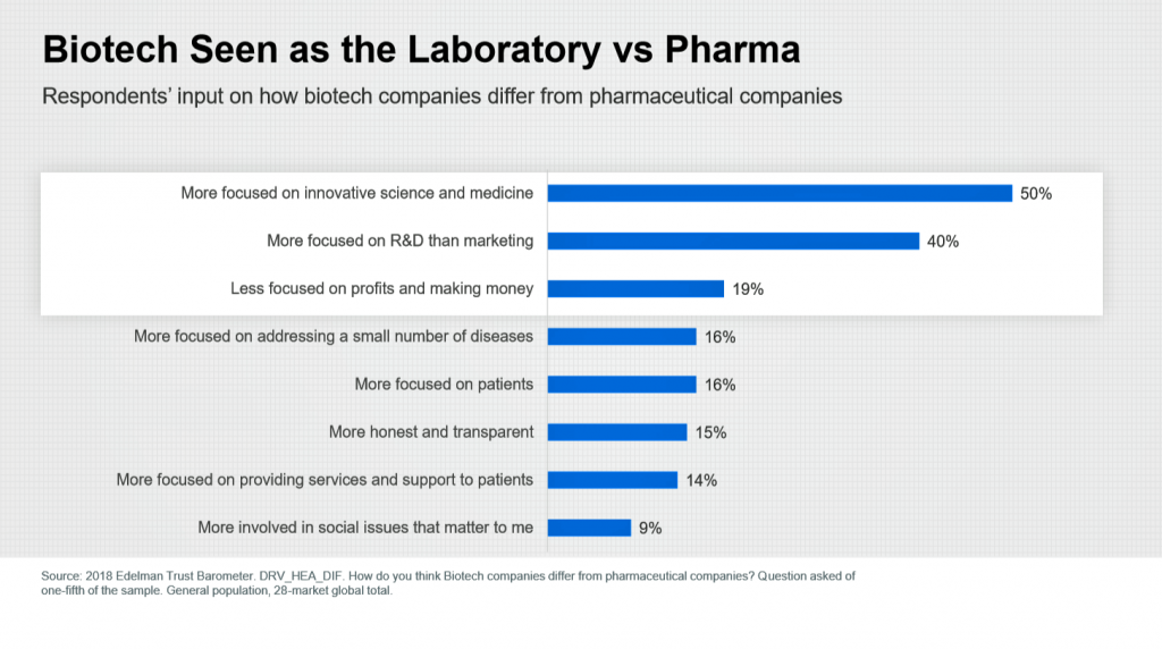

Americans’ Trust in the Healthcare System Low Compared to Rest-of-World’s Health Citizens

In the U.S., trust in the healthcare industry declined by 9 percentage points in just one year, declining from 62% of people trusting — that’s roughly two-thirds of Americans — down to 53% — closer to one-half of the population. I covered the launch of the 2018 Edelman Trust Barometer across all industries here in Health Populi in January 2018, when this year’s annual report was presented at the World Economic Forum in Davos as it is each year. The Edelman team shared this detailed data on the healthcare sector with me this week, for which I am grateful. Check

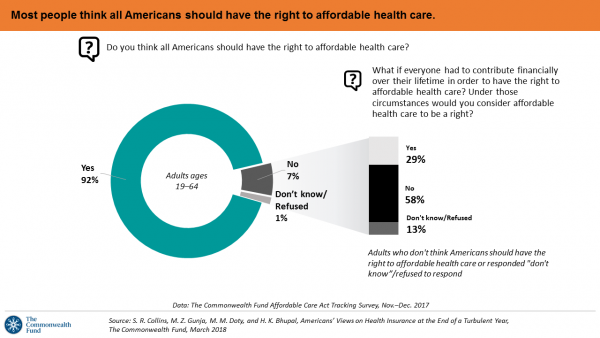

Majority Rules? The Right to Affordable Health Care is A Right for All Americans

If we’re playing a game of “majority rules,” then everyone in America would have the right to affordable health care, according to a new poll from The Commonwealth Fund. The report is aptly titled, Americans’ Views on Health Insurance at the End of a Turbulent Year. The Fund surveyed 2,410 U.S. adults, age 19 to 64, by phone in November and December 2017. This is the sixth survey conducted by the Fund to track Americans’ views of the Affordable Care Act; the first survey was fielded in mid-to-fall 2013. 9 in 10 working-age adults say “yes” indeed, my fellow Americans

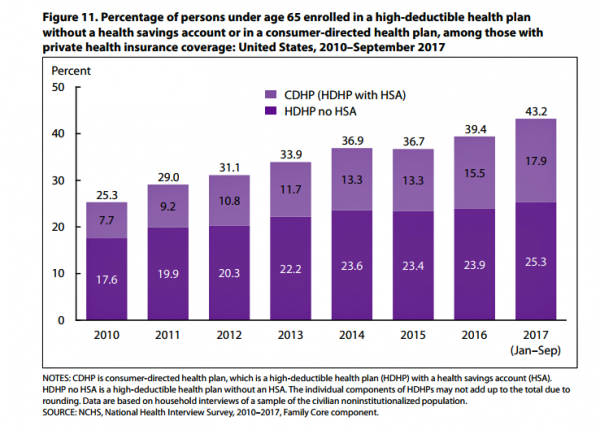

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

Consumer Health and Patient Engagement – Are We There Yet?

Along with artificial intelligence, patient engagement feels like the new black in health care right now. Perhaps that’s because we’re just two weeks out from the annual HIMSS Conference which will convene thousands of health IT wonks, users and developers (I am the former), but I’ve received several reports this week speaking to health engagement and technology that are worth some trend-weaving. As my colleague-friends Gregg Masters of Health Innovation Media (@2healthguru) and John Moore of Chilmark Research (@john_chilmark) challenged me on Twitter earlier this week: are we scaling sustained, real patient engagement and empowerment yet? Let’s dive into the

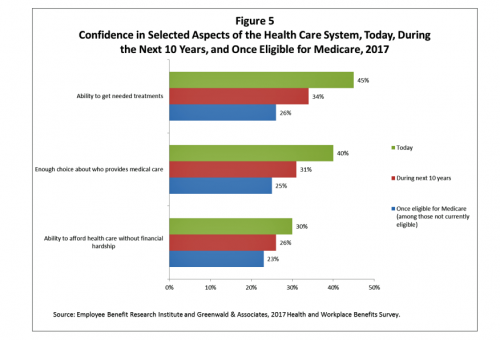

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

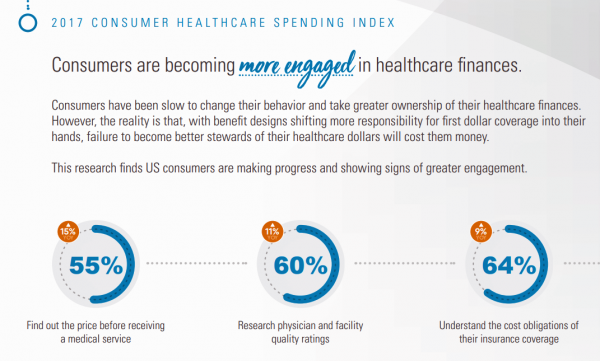

Patients Continue to Grow Healthcare Consumer Muscles, Alegeus’s 2017 Index Finds

Patients’ health consumer muscles continue to get a work out as more people enroll in high-deductible health plans and face sticker shock for health insurance premiums, prescription drug costs, and that thousand-dollar threshold. The 2017 Alegeus Healthcare Consumerism Index finds growth in patients’, now consumers’, interest and competence in becoming disciplined about planning, saving, and spending for healthcare. Overall, the healthcare spending index hit 60.1 in 2017, up from 54.4 in 2016. This is a macro benchmark that represents most consumers exhibiting greater healthcare spending engagement with eyes on cost as well as adopting purchasing behaviors for healthcare. Underneath that

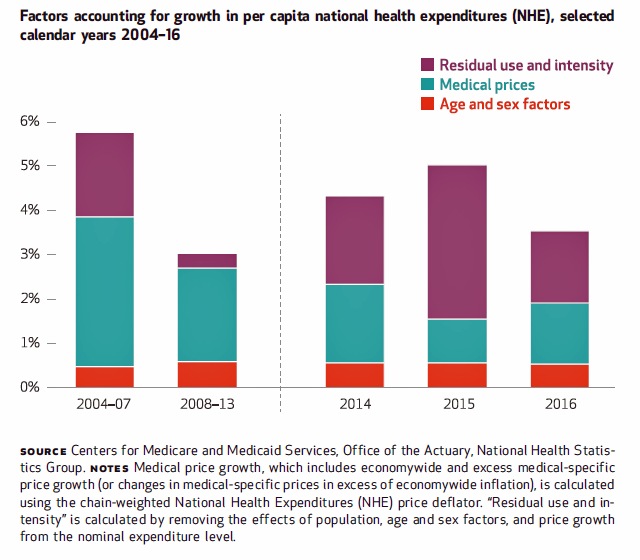

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

High-Deductibles Do Not Automatically Inspire Healthcare Consumerism

It takes more than enrolling in a high-deductible health plan (HDHP) for someone to immediately morph into an effective health care “consumer.” Research from Dr. Jeffrey Kullgren and his team from the University of Michigan found that enrollees in HDHPs could garner more benefits from these plans were people better informed about how to use them, including how to save for them and spend money once enrolled in them. The team’s research letter was published in JAMA Internal Medicine on 27 November 2017. The discussion details results of a survey conducted among 1,637 people 18 to 64 years of age

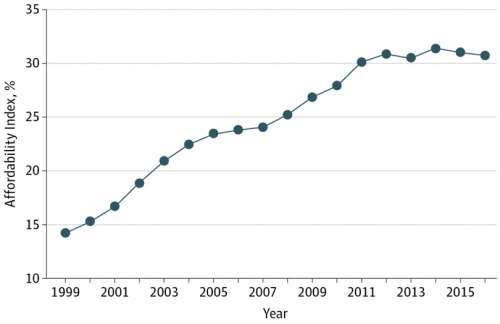

Health Care Is 2.5 More Expensive Than Food for the Average U.S. Family

The math is straightforward. Assume “A” equals $59.039, the median household income in 2016. Assume “B” is $18,142, the mean employer-sponsored family insurance premium last year. B divided by A equals 30.7%, which is the percent of the average U.S. family’s income represented by the premium cost of health insurance. Compare that to what American households spent on food: just over $7,000, including groceries and eating out (which is garnering a larger share of U.S. eating opportunities, a topic for another post). Thus, health care represents, via the home’s health insurance premium, represents 2.5 times more than food for the

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

Consumers Use Digital Health Tools But Still Struggle with Health Literacy

While more U.S. patients are use digital health tools and take on more clinical and financial decision making for their health care, people also have gaps in health engagement and health literacy. Three studies published in early October 2017 provide insights into the state of healthcare consumerism in America. The 2017 UnitedHealthcare Consumer Sentiment Survey found that a plurality of Americans (45%) turn first to primary care providers (doctors or nurses) as their source for the first source of information about specific health symptoms, conditions or diseases. 28% of people also use the internet or mobile health apps as their

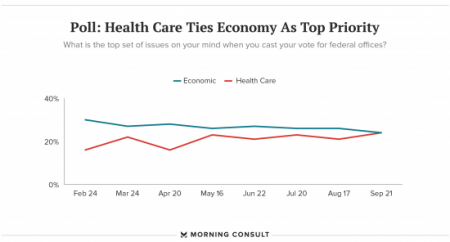

The Patient As Payor – Americans Bundle Financial Wellness and Healthcare Costs

Healthcare and the economy tied for US voters’ top issue last week, as the prospects for repealing the Affordable Care Act faded by the weekend. This Morning Consult poll was published 28th September 2017, as it became clear that the Graham-Cassidy health reform bill would lose at least three key votes the legislation needed for passage: from Rand Paul, Susan Collins, and John McCain. Liz Hamel, who directs the Kaiser Family Foundation’s survey research, told Morning Consult that, “when people say ‘health care,’ they often are actually talking about the economic issue of health care.”

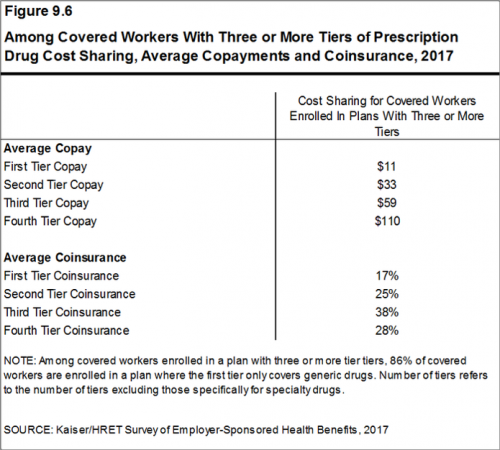

Prescription Drug Coverage at Work: Common, Complex, and Costly

Getting health insurance at work means also having prescription drug coverage; 99% of covered workers’ companies cover drugs, based on the 2017 Employer Health Benefits Survey released by the Kaiser Family Foundation (KFF). I covered the top-line of this important annual report in yesterday’s Health Populi post, which found that the health insurance premium for a family of four covered in the workplace has reached $18,764 — approaching the price of a new 2017 small car according to the Kelley Blue Book. The complexities of prescription drug plans have proliferated, since KFF began monitoring the drug portion of health benefits

Patients’ Healthcare Payment Problems Are Providers’, Too

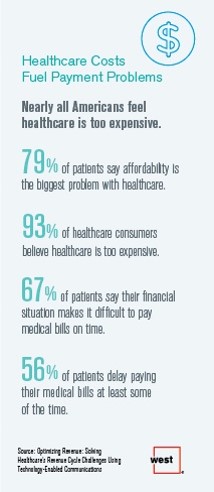

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

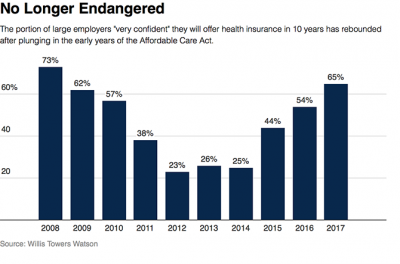

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

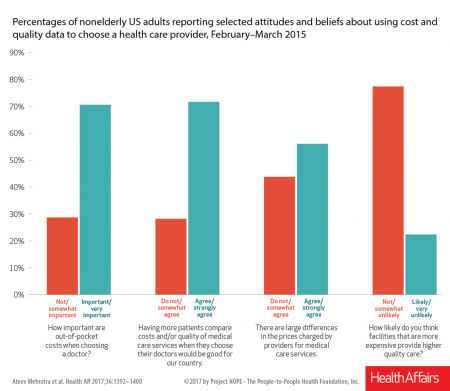

Price-Shopping for Healthcare Still A Heavy Lift for Consumers

Most U.S. consumers support the idea of price-shopping for healthcare, but don’t practice it. While patients “should” shop for health care and perceive differences in costs across providers, few seek information about their personal out-of-pocket costs before getting treatment. Few Americans shop around for health care, even when insured under a high-deductible health plan, conclude Ateev Mehrotra and colleagues in their research paper, Americans Support Price Shopping For Health Care, But Few Actually Seek Out Price Information. The article is published in Health Affairs‘ August 2017 issue. The bar chart shows some of the survey results, with the top-line finding

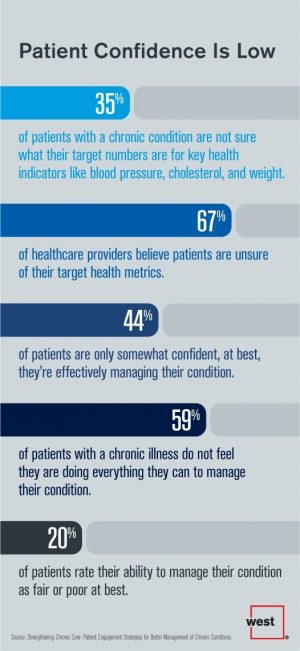

Strengthening Chronic Care Is Both Personal and Financial for the Patient

6 in 10 people diagnosed with a chronic condition do not feel they’re doing everything they can to manage their condition. At the same time, 67% of healthcare providers believe patients aren’t certain about their target health metrics. Three-quarters of physicians are only somewhat confident their patients are truly informed about their present state of health. Most people and their doctors are on the same page recognizing that patients lack confidence in managing their condition, but how to remedy this recognized challenge? The survey and report, Strengthening Chronic Care, offers some practical advice. This research was conducted by West

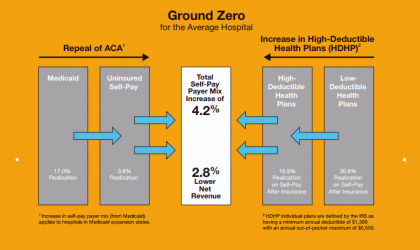

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

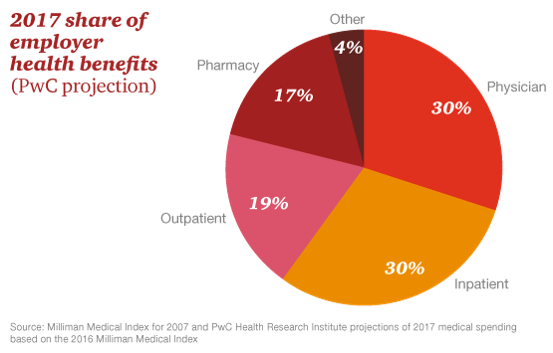

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

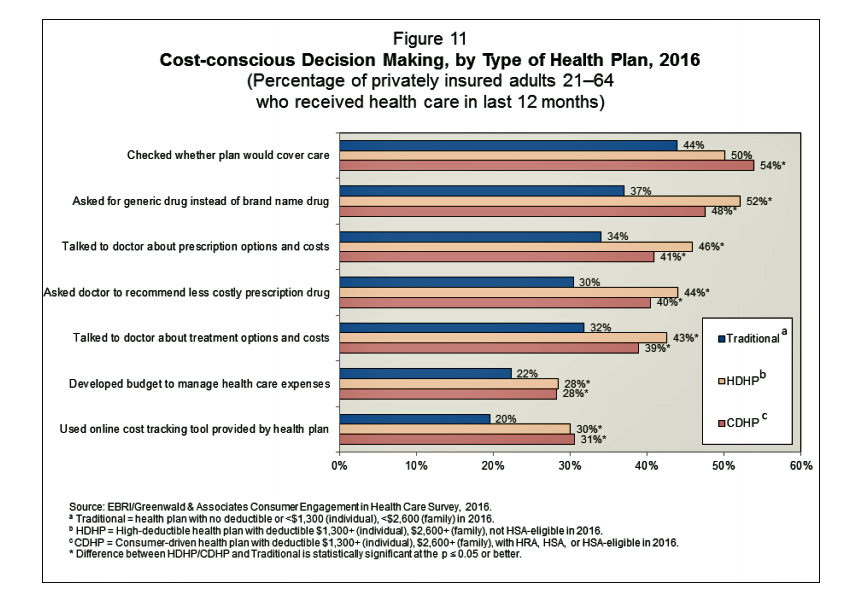

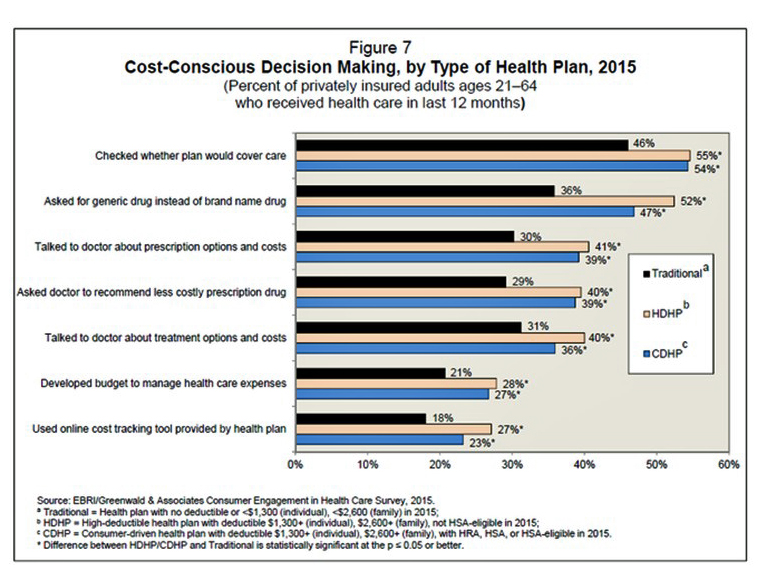

As High Deductible Health Plans Grow, So Does Health Consumers’ Cost-Consciousness

A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute. A high deductible is correlated with more engaged health plan members, EBRI believes based on the data. One example: more than one-half of people enrolled

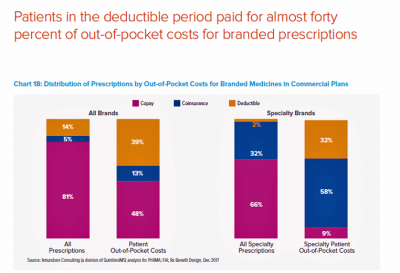

Medicines in America: The Half-Trillion Dollar Line Item

Prescription drug spending in the U.S. grew nearly 6% in 2016, reaching $450 billion, according to the QuintilesIMS Institute report, Medicines Use and Spending in the U.S., published today. U.S. drug spending is forecasted to grow by 30% over the next 5 years to 2021, amounting to $610 billion. In 2016, per capita (per person) spending on medicines for U.S. health citizens averaged $895. Specialty drugs made up $384 of that total, equal to 43% of personal drug spending, shown in the first chart. Spending on specialty drugs continues to increase as a proportion of total drug spending: traditional medicines’ share

Healthier Eating Is the Peoples’ Health Reform: the Gallup-Sharecare Well-Being Index

The top healthiest eating communities tend to circle the perimeter of the map of the lower 48 U.S. states. In these towns, more than 72% of health citizens report healthy eating. These areas are located in California, Florida, and Massachusetts, among others. Areas with the lowest rates of healthy eating are concentrated generally south of the Mason-Dixon Line, in places like Arkansas, Kentucky, and Mississippi, and other states. In these places, fewer than 57% of people eat healthy. Eating healthy foods in moderation is a mighty contributor to personal and public health, discussed in the report, State of American Well-Being

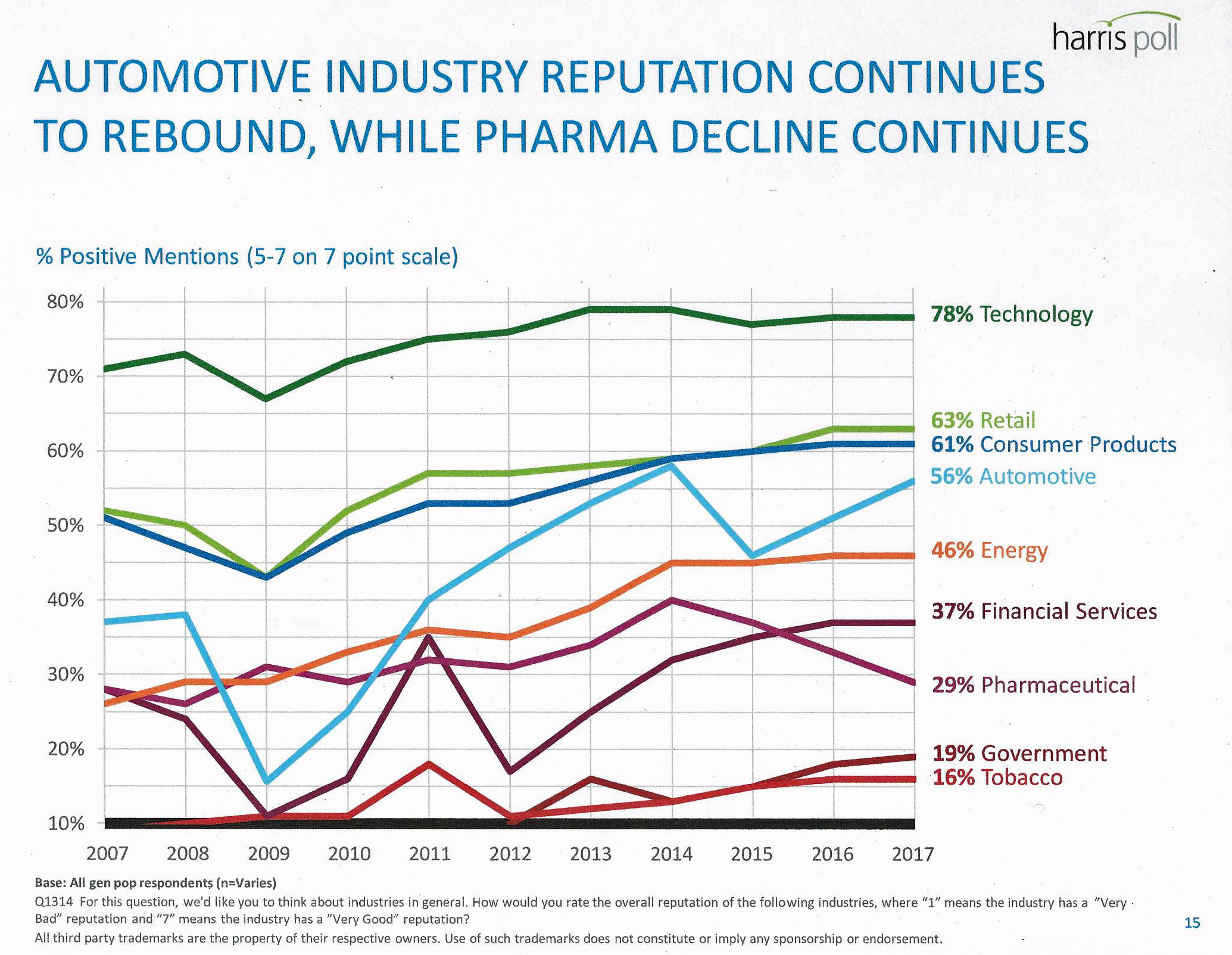

Pharma Industry Reputation Declines Second Year In A Row

U.S. consumers love technology, retail, and consumer products; automotive company reputations are improving, even with Volkswagen’s emission scandal potentially tarnishing the industry segment. The only corporate sector whose reputation fell in 2016 was the pharmaceutical industry’s, according to the Harris Poll’s 2017 Reputation Quotient report. The line chart illustrates the decline of pharma’s reputation, which puts it on par with its consumer perceptions in 2010 — just before Medicare Part D was legislated and implemented, which improved pharma’s image among American health citizens (especially older patients who tend to be more frequent consumers of prescription drugs). Pharma’s reputation quotient is back

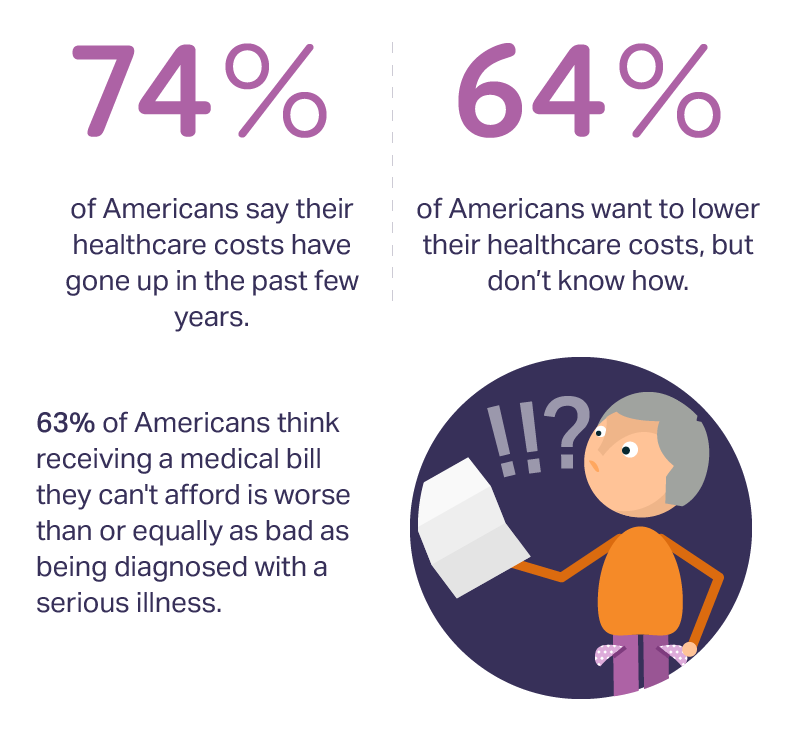

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

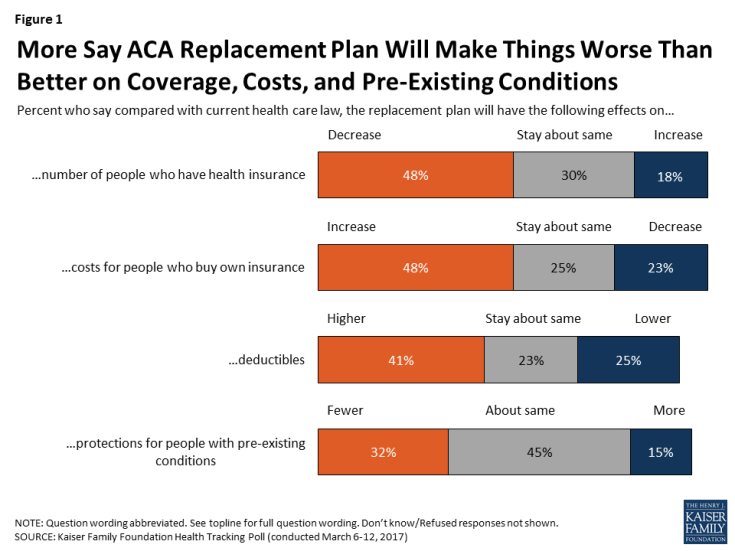

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

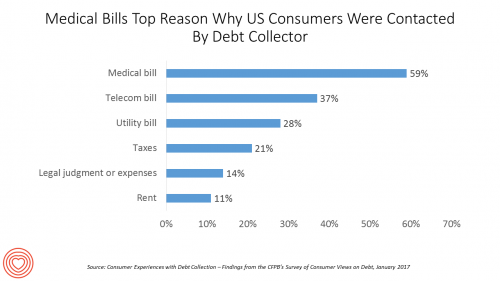

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

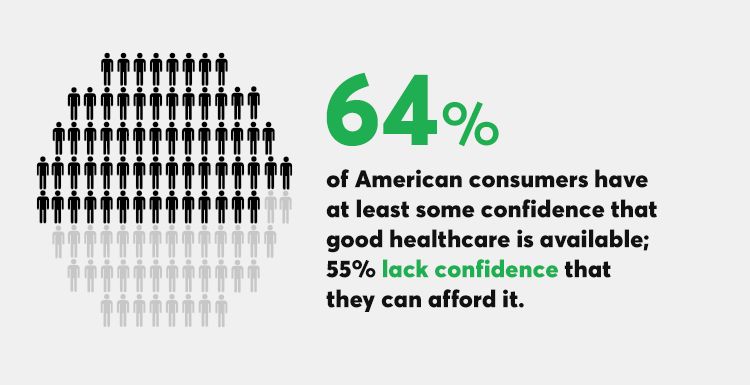

Health Care For All — Only Better, US Consumers Tell Consumer Reports

Availability of quality healthcare, followed by affordable care, are the top two issues concerning U.S. consumers surveyed just prior to Donald Trump’s inauguration as the 45th U.S. President. Welcome to Consumer Reports profile of Consumer Voices, As Trump Takes Office, What’s Top of Consumers’ Minds? “Healthcare for All, Only Better,” Consumer Reports summarizes as the top-line finding of the research. 64% of people are confident of having access to good healthcare, but 55% aren’t sure they can afford healthcare insurance to be able to access those services. Costs are too high, and choices in local markets can be spotty or non-existent.

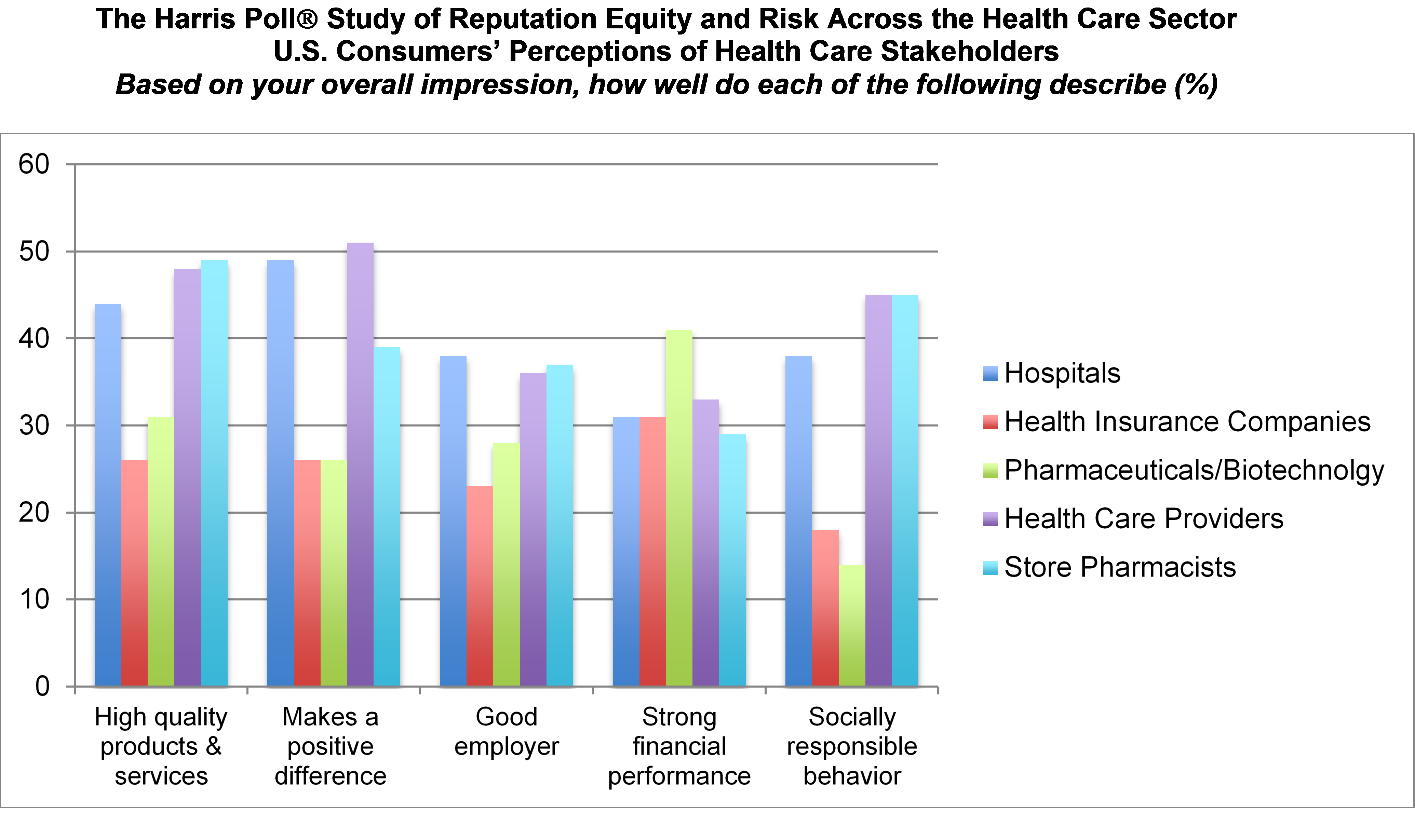

Pharma’s Branding Problem – Profits Over Patients

Nine in 10 U.S. consumers think pharma and biotech put profits above patient interests, according to the latest Harris Poll studying reputation equity across organizations serving health care. Notice the relatively low position of the green bars in the first chart (with the exception of the impression for “strong financial performance); these are the pharma/biotech consumer impressions. The health industry stakeholders consumers believe would more likely place them above making money are health care providers, like doctors and nurses, hospitals, and pharmacists. Health insurance companies fare somewhat better than pharma and biotech in this Poll, although rank low on social

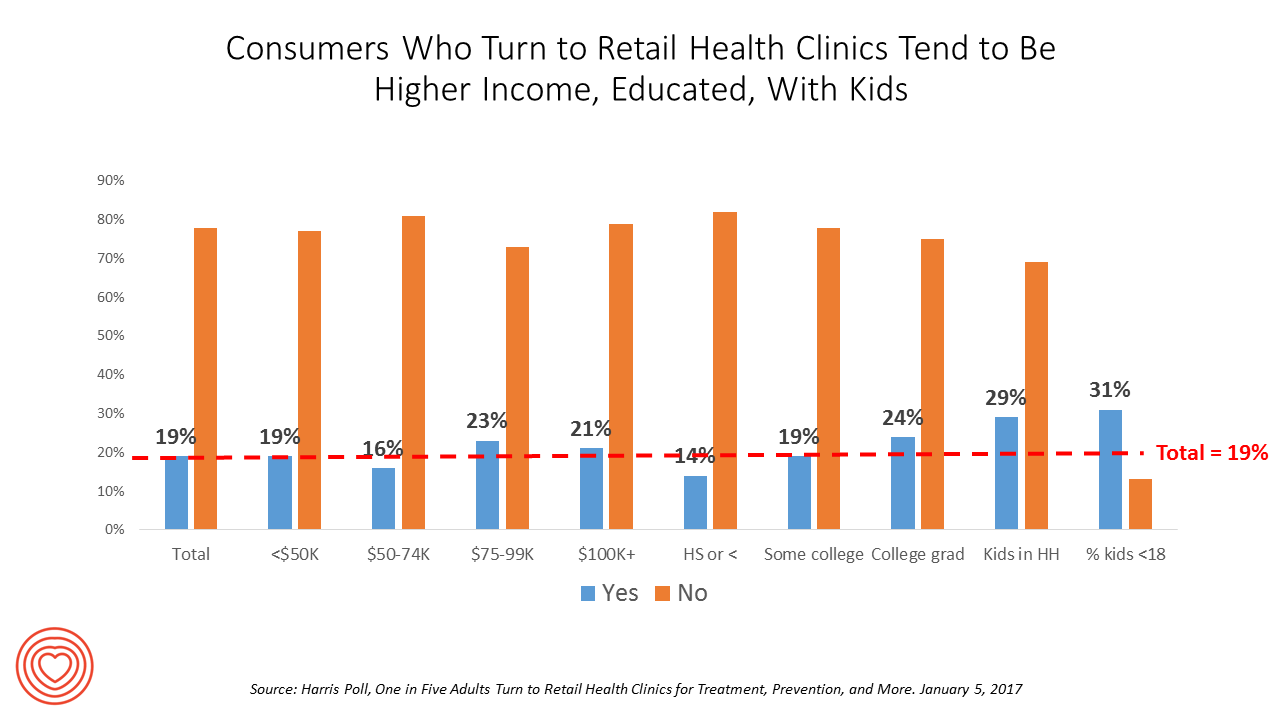

More Consumers Use Retail Health Clinics for Healthcare Management, Harris Finds

1 in 5 U.S. adults used a retail clinic in 2016. Increasingly, health consumers seek care from retail clinics for more complex healthcare services beyond flu shots and pre-school exams, according to the Harris Poll’s survey, One in Five Adults Turn to Retail Health Clinics for Treatment, Prevention, and More, published January 5, 2017. Additional points the poll revealed are worth attention for public health policy purposes: Twice as many people who identify as LGBT turn to retail clinics than others (35% vs. 18%) Older people frequent retail clinics for flu vaccines more than younger people do More younger men

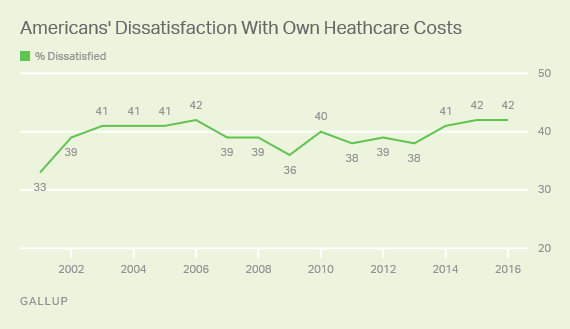

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

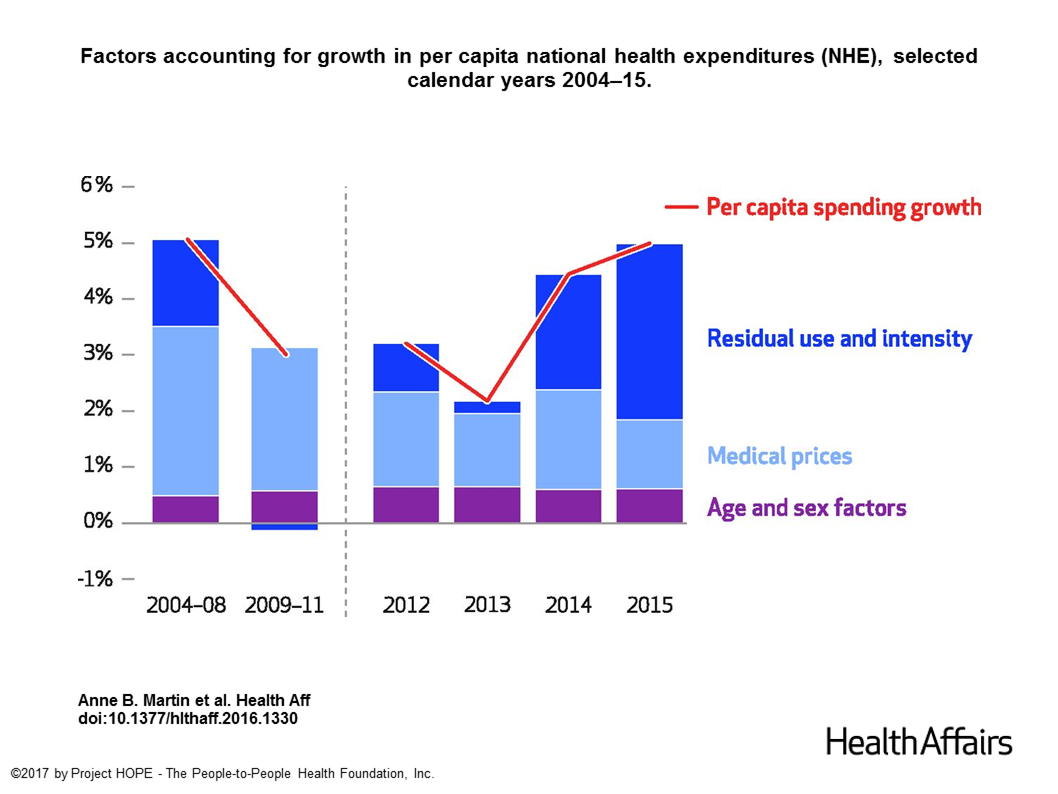

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

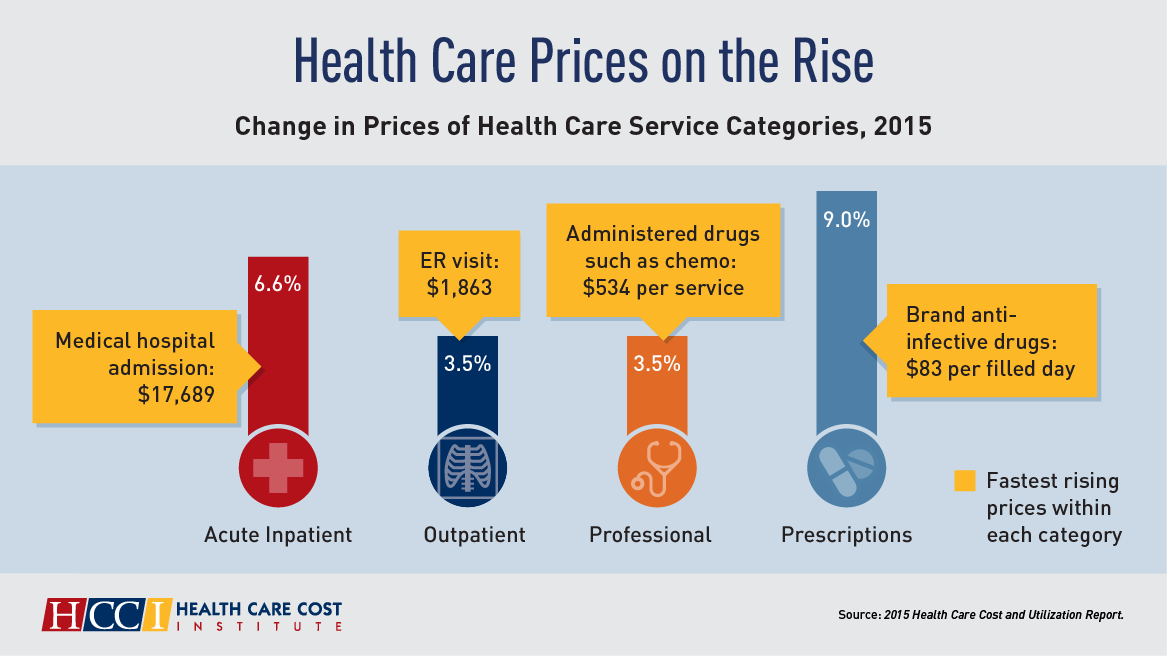

Both Healthcare Prices and Use of Services Driving Up Spending

Health care spending grew 4.6% in 2015, higher than the rise in either 2013 or 2014, according to the 2015 Health Care Cost and Utilization Report published by HCCI, the Health Care Cost Institute. The key contributors to health care spending by percentage were, first and foremost, prescription drugs which rose 9% in the year — notably, specialty medicines like anti-infective drugs (such as those for Hepatitis C and HIV) costing on average $83 per “filled day.” This cost doubled from $53 per person in 2012 to $101 per person in 2015. Hospital costs saw the second greatest percentage price increase

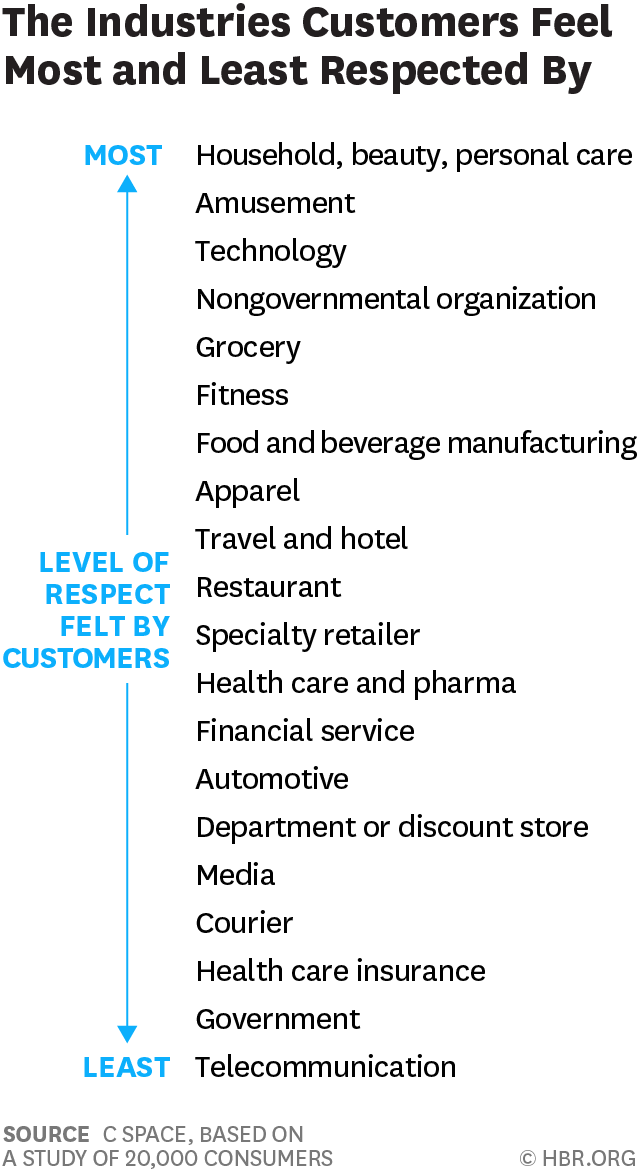

Consumers Feel More Respect from Personal Care and Grocery Brands Than Pharma or Insurance

People feel like get-no-respect Rodney Dangerfield when they deal with health insurance, government agencies, or pharma companies. Consumers feel much more love from personal care and beauty companies, grocery and fitness, according to a brand equity study by a team from C Space, published in Harvard Businss Review. As consumer-directed health care (high deductibles, first-dollar payments out-of-pocket) continues to grow, bridging consumer trust and values will be a critical factor for building consumer market share in the expanding retail health landscape. Nine of the top 10 companies C Space identified with the greatest “customer quotient” are adjacent in some way to health:

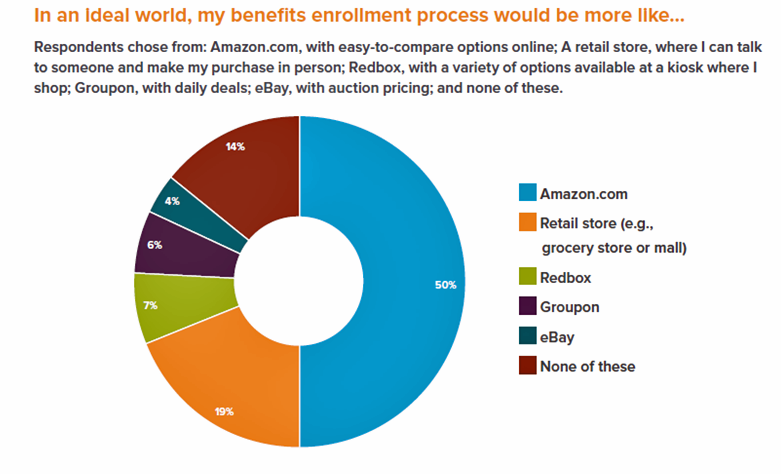

Looking for Amazon in Healthcare

Consumers have grown accustomed to Amazon, and increasingly to the just-in-time convenience of Amazon Prime. Today, workers who sign onto employee benefit portals are looking for Amazon-style convenience, access, and streamlined experiences, found in the Aflac Workforces Report 2016. Aflac polled 1,900 U.S. adults employed full or part time in June and July 2016 to gauge consumers’ views on benefit selections through the workplace. Consumers have an overall angst and ennui about health benefits sign-ups: 72% of employees say reading about benefits is long, complicated, or stressful 48% of people would rather do something unpleasant like talking to their ex or

Let’s Go Healthcare Shopping!

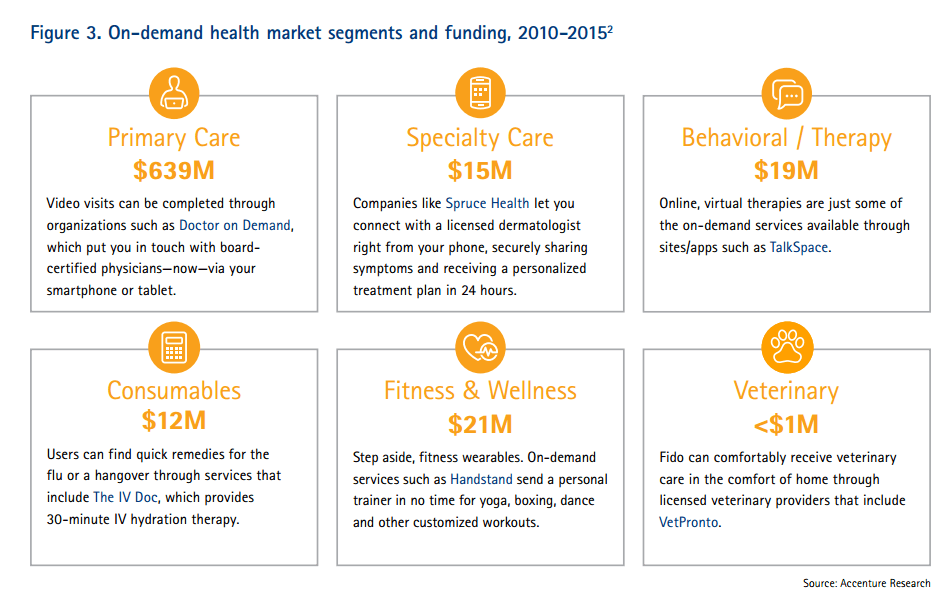

Healthcare is going direct-to-consumer for a lot more than over-the-counter medicines and retail clinic visits to deal with little Johnny’s sore throat on a Sunday afternoon. Entrepreneurs recognize the growing opportunity to support patients, now consumers, in going shopping for health care products and services. Those health consumers are in search of specific offerings, in accessible locations and channels, and — perhaps top-of-mind — at value-based prices as defined by the consumer herself. (Remember: value-based healthcare means valuing what matters to patients, as a recent JAMA article attested). At this week’s tenth annual Health 2.0 Conference, I’m in the zeitgeist

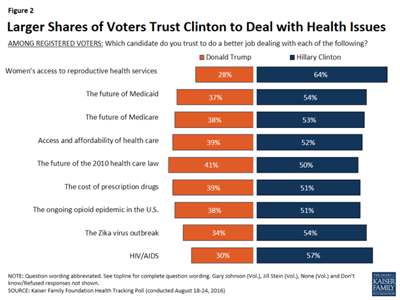

More Americans See Hillary Clinton As the 2016 Presidential Health Care Candidate

When it comes to health care, more American voters trust Hillary Clinton to deal with health issues than Donald Trump, according to the Kaiser Health Tracking Poll: August 2016 from the Kaiser Family Foundation (KFF). The poll covered the Presidential election, the Zika virus, and consumers’ views on the value of and access to personal health information via electronic health records. Today’s Health Populi post will cover the political dimensions of the August 2016 KFF poll; in tomorrow’s post, I will address the health information issues. First, let’s address the political lens of the poll. More voters trust Hillary Clinton to do

Medical Tourism On A Cruise Ship

Health is everywhere: where we live, work, play, and learn, as I’ve often written here on Health Populi. While I’ve also analyzed the market for medical tourism over the past twenty years, this week I’ve learned that it extends to the cruise travel industry along with hospitals and clinics around the world. I had the pleasure of meeting up this week with Hannah Jean Taylor, Manager of the Mandara Spa on Norwegian Cruise Line‘s ship, The Norwegian Breakaway. This vessel accommodates nearly 4,000 passengers who enjoy the services of over 1,600 staff members in the hotel, entertainment, and operational crews.

Employers Changing Health Care Delivery – Health Reform At Work

Large employers are taking more control over health care costs and quality by pressuring changes to how care is actually delivered, based on the results from the 2017 Health Plan Design Survey sponsored by the National Business Group on Health (NBGH). Health care cost increases will average 5% in 2017 based on planned design changes, according to the top-line of the study. The major cost drivers, illustrated in the wordle, will be specialty pharmacy (discussed in yesterday’s Health Populi), high cost patient claims, specific conditions (such as musculoskeletal/back pain), medical inflation, and inpatient care. To temper these medical trend increases,

The Future of Retail Health in 2027

As consumers gain more financial skin in the game of paying for health care, we look for more retail-like experiences that reflect the Burger King approach to consuming: having it our way. For health are, that means access, convenience, transparency and fair costs, respect for our time, and a clear value proposition for services rendered. That doesn’t happen so much in the legacy health care system — in hospitals and doctors’ offices. It has already begun to happen in retail health settings and, especially, in the changing nature of pharmacies. Retail Health 2027, a special supplement to Drug Store News

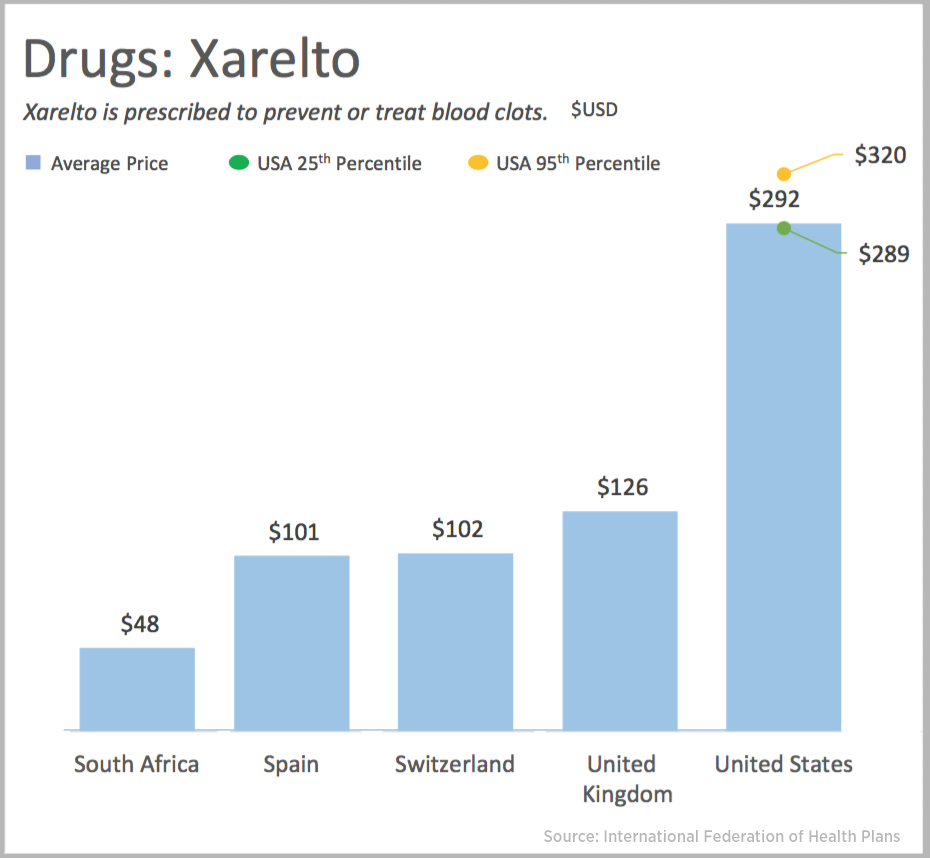

US Health Care Prices Would Be Sticker-Shocking For Europeans

The average hospital cost per day in the U.S. is $5,220. In Switzerland it’s $4,781, and in Spain that inpatient day looks like a bargain at $424. An MRI in the U.S. runs, on average, $1,119. In the UK, that MRI is $788, and in Australia, $215, illustrated in the first chart. Drug prices are strikingly greater in the U.S. versus other developed nations, as shown in the first chart for Xarelto. If you live in the U.S. and have a television tuned in during the six o’clock news, chances are you’ve seen an ad for this drug featuring Arnold

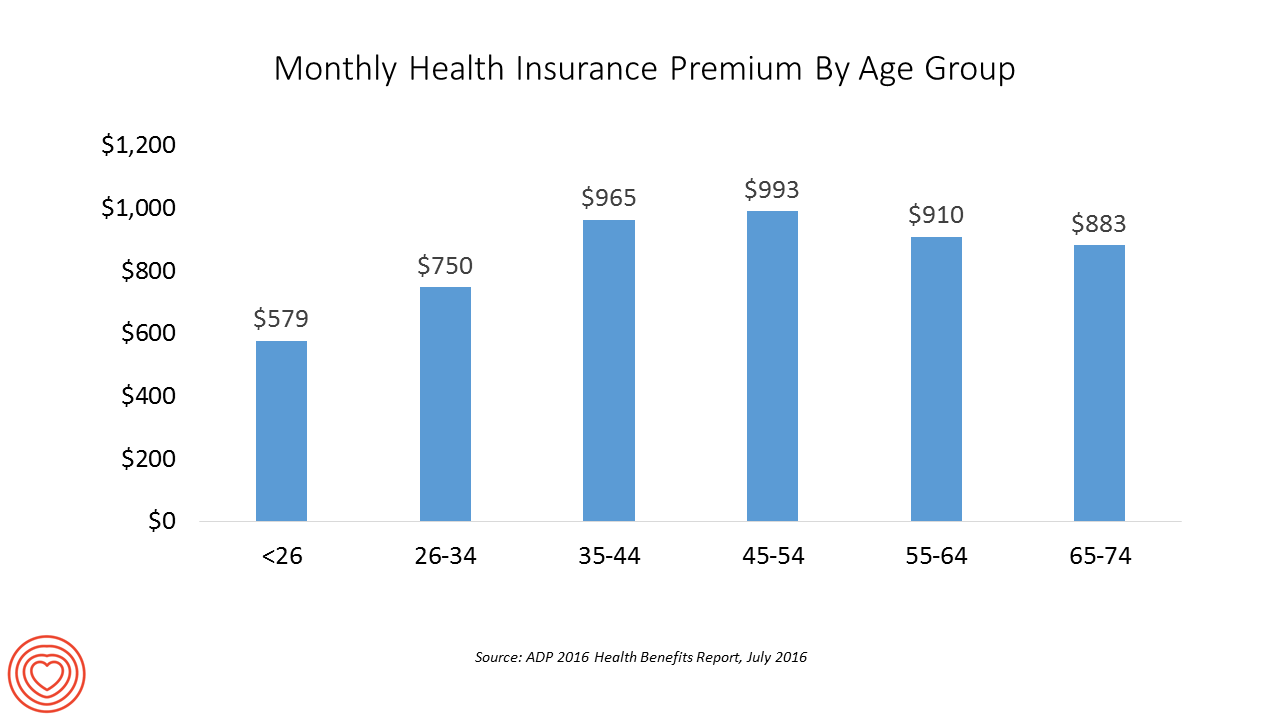

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

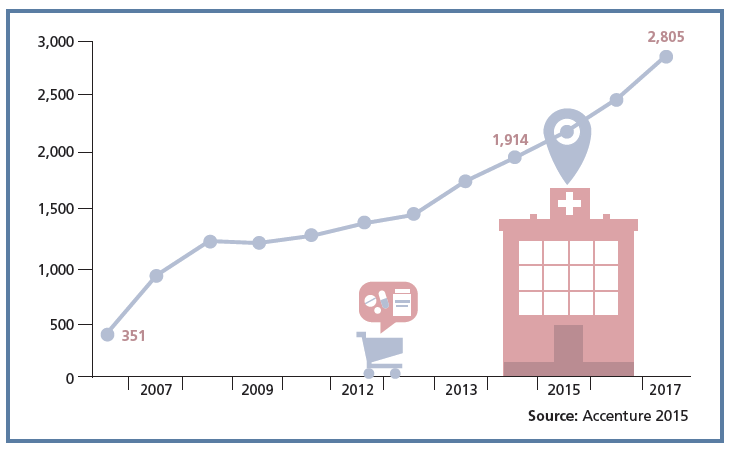

Retail Clinics Continue to Shape Local Healthcare Markets

Retail clinics are a growing source of primary care for more U.S. health consumers, discussed in a review of retail clinics published by Drug Store News in July 2016. There will be more than 2,800 retail clinics by 2018, according to Accenture’s tea leaves. Two key drivers will bolster retail clinics’ relevance and quality in local health delivery systems: Retail clinics’ ability to forge relationships with legacy health care providers (physicians, hospitals); and, Clinics’ adoption and effective use of information technology that enables data sharing (e.g., to the healthcare provider’s electronic health records system) and data liquidity (that is, securely moving

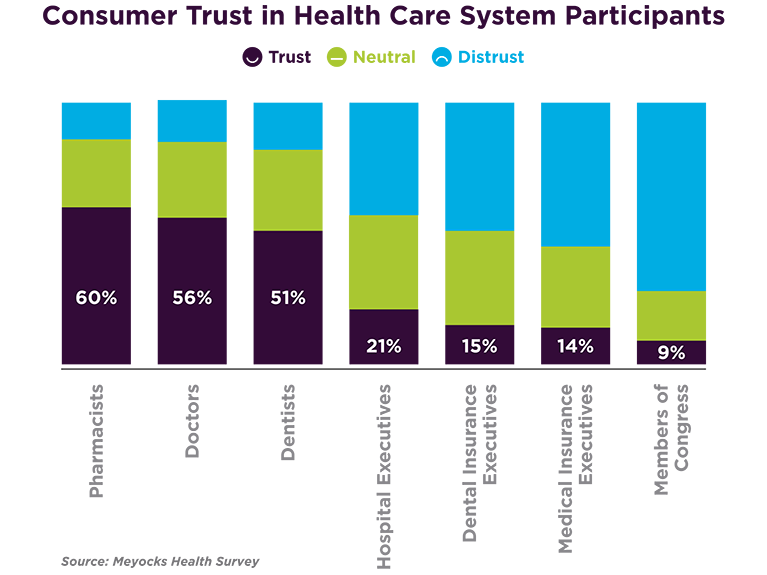

In Healthcare, Pharmacists and Doctors Most Trusted. Insurance Execs and Congress? Not.

When consumers consider the many stakeholder organizations in healthcare, a majority trust pharmacists first, then doctors and dentists. Hospital and health insurance execs, and members of Congress? Hardly, according to a survey from Meyocks, a marketing consultancy. Meyocks conducted the survey via email among 1,170 US adults, 18 years of age and older. This survey correspondends well with the most recent Gallup Poll on most ethical professions, conducted in December 2015. In that study, pharmacists, nurses and doctors come out on top, with advertisers (“Mad Men”), car salespeople, and members of Congress at the bottom, as shown in the second

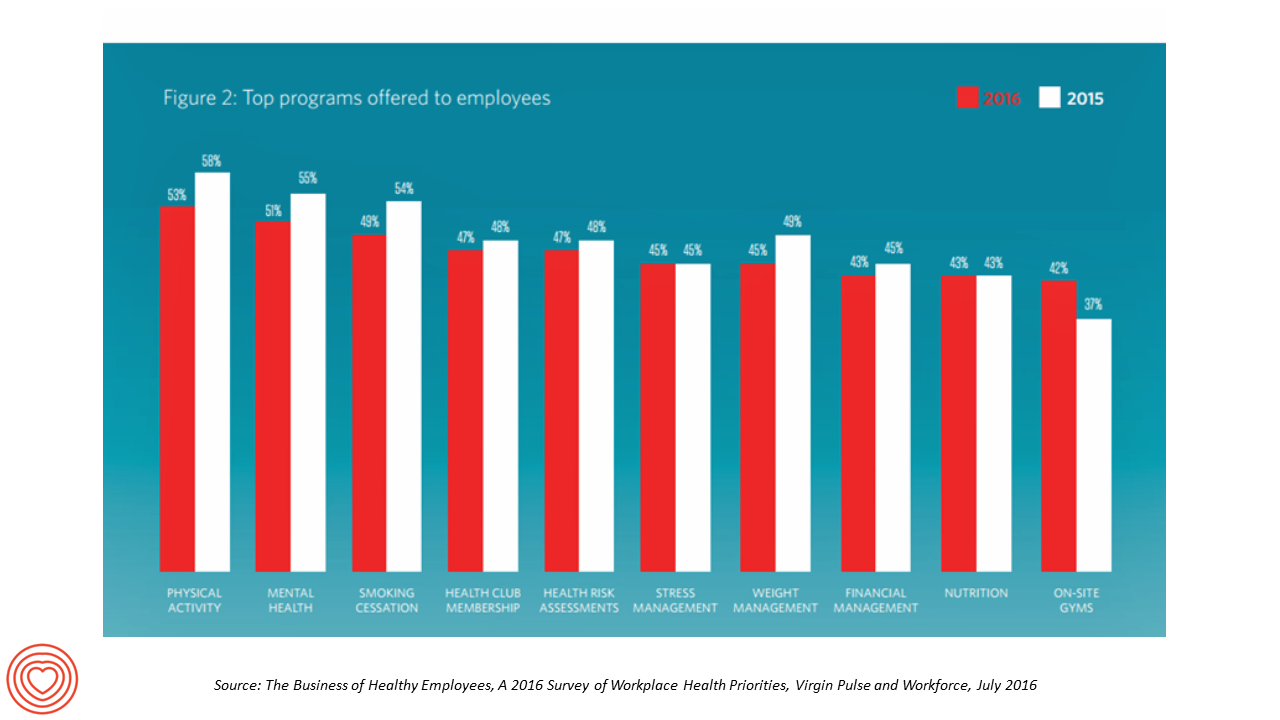

Workplace Wellness Goes Holistic, Virgin Pulse Finds

“Work is the second most common source of stress, just behind financial worries,” introduces The Business of Healthy Employees report from Virgin Pulse, the company’s 2016 survey of workplace health priorities published this week. Virgin Pulse collaborated with Workforce magazine, polling 908 employers and 1,818 employees about employer-sponsored health care, workers’ health habits, and wellness benefit trends. Workplace wellness programs are becoming more holistic, integrating a traditional physical wellness focus with mental, social, emotional and financial dimensions for 3 in 4 employers. Wearable technology is playing a growing role in the benefit package and companies’ cultures of health, as well

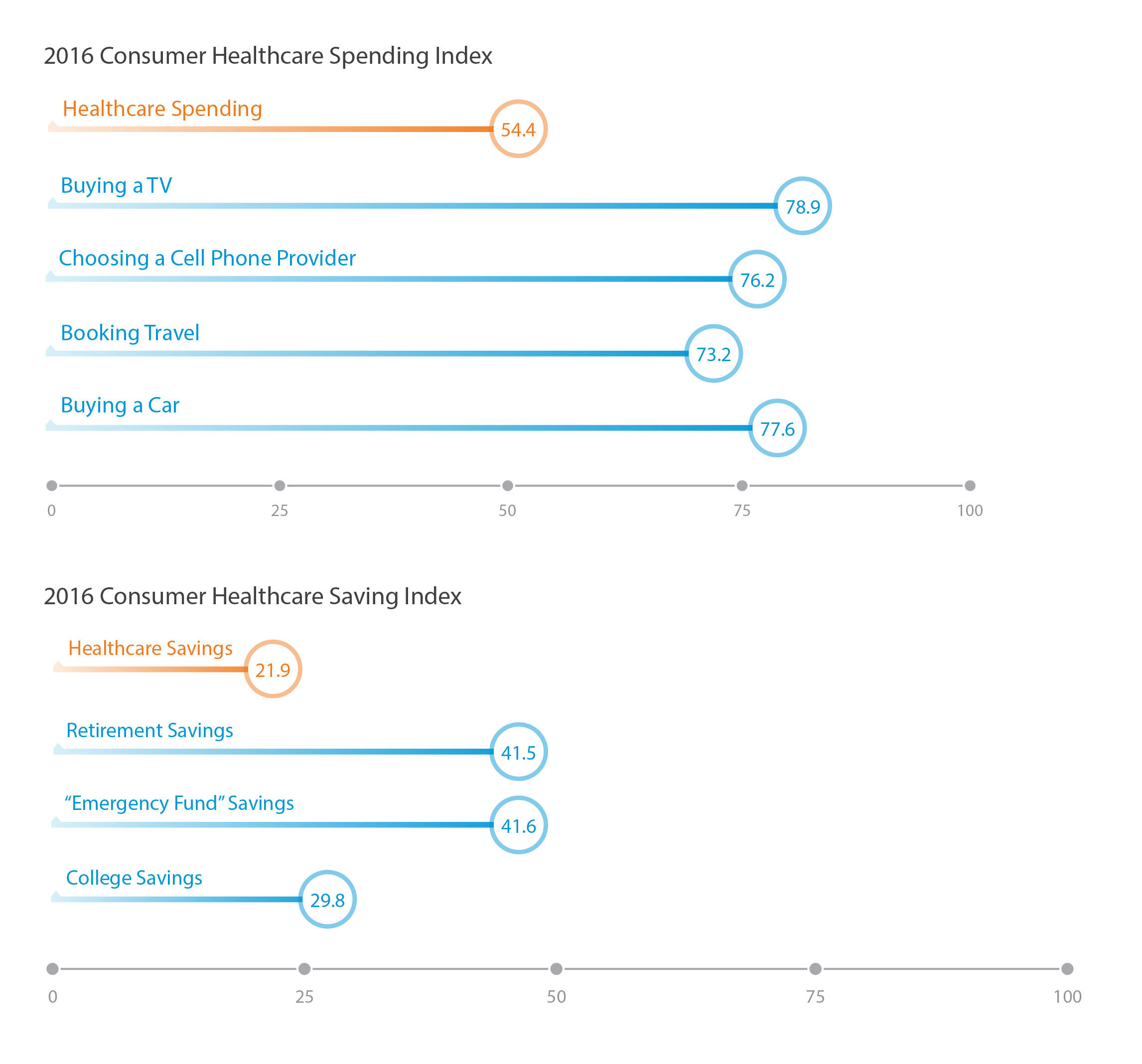

Healthcare Consumerism? Not So Fast, Alegeus Finds

Millions of U.S. patients have more financial skin in the American health care game. But are they behaving like the “consumers” they are assumed to be as members in consumer-directed health plans? Not so much, yet, explained John Park, Chief Strategy Officer at Alegeus, during a discussion of his company’s 2016 Healthcare Consumerism Index. This research is based on an online survey of over 1,000 U.S. healthcare consumers in April 2016. Alegeus looks at healthcare consumerism across two main dimensions: healthcare spending and healthcare saving. As the chart summarizes, consumers show greater engagement and focus on buying a TV or car, choosing

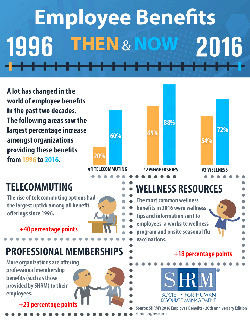

The State of Health Benefits in 2016: Reallocating the Components

Virtually all employers who offer health coverage to workers extend health benefits to all full-time employees. 94% offer health care coverage to opposite-sex spouses, and 83% to same-sex spouses. One-half off health benefits to both opposite-sex and same-sex domestic partners (unmarried). Dental insurance, prescription drug coverage, vision insurance, mail order prescription programs, and mental health coverage are also offered by a vast majority (85% and over) of employers. Welcome to the detailed profile of workplace benefits for the year, published in 2016 Employee Benefits, Looking Back at 20 Years of Employee Benefits Offerings in the U.S., from the Society for Human

PwC’s “Behind the Numbers” – Where the Patient Stands

The growth of health care costs in the U.S. is expected to be a relatively moderate 6.5% in 2017, the same percentage increase as between 2015 and 2016, according to Medical Cost Trend: Behind the Numbers 2017, an annual forecast from PwC. As the line chart illustrates, the rate of increase of health care costs has been declining since 2007, when costs were in double-digit growth mode. Since 2014, health care cost growth has hovered around the mid-six percent’s, considered “low growth” in the PwC report. What’s driving overall cost increases is price, not use of services: in fact, health care

Will the Big Box Store Be Your Health Provider?

“Gas ‘N’ Health Care” is one of my most-used cartoons these days as I talk with health/care ecosystem stakeholders about the growing and central role of consumers in health care. You may be surprised to learn that the brilliant cartoonist Michael Maslin created this image back in 1994. That’s 22 years ago. When I first started using this image in my meetings with health care folks, they’d all giggle and think, ‘isn’t that funny?’ Legacy health care players — hospitals, doctors, Pharma, and medical device companies — aren’t laughing at this anymore. At a Costco a 20 minutes’ drive from

Love, Mercy and Virtual Healthcare

Virtual healthcare – call it telemedicine, remote monitoring, or the umbrella term, telehealth – is coming of age. And it’s a form of healthcare that a growing percentage of consumers in the U.S. want. I’m in Branson, Missouri, today, meeting with the State’s Hospital Association to talk about consumers in the growing DIY health/care economy. So “telehealth,” broadly defined, is part of my message. This week Xerox announced its survey results focused on consumers’ interests in telehealth. “Xerox helps healthcare providers serve patients anytime, anywhere,” the press release starts. Convenience, cost-savings, and the ability to consult physicians quickly and get e-refills are

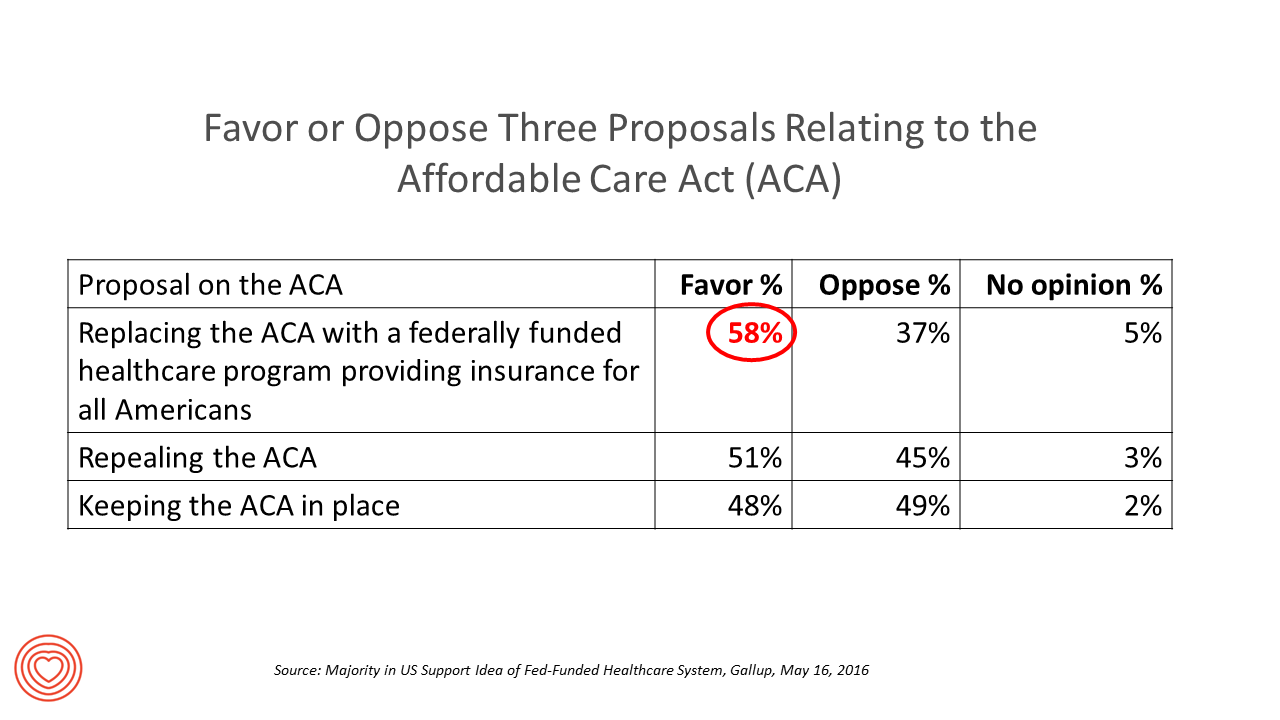

Most Americans Favor A Federally-Funded Health System

6 in 10 people in the US would like to replace the Affordable Care Act with a national health insurance program for all Americans, according to a Gallup Poll conducted on the phone in May 2016 among 1,549 U.S. adults. By political party, RE: Launch a Federal/national health insurance plan (“healthcare a la Bernie Sanders”): Among Democrats, 73% favor the Federal/national health insurance plan, and only 22% oppose it; 41% of Republicans favor it and 55% oppose it. RE: Repeal the ACA (“healthcare a la Donald Trump”): Among Democrats, 25% say scrap the ACA, and 80% of Republicans say to do

GoHealthEvents, An Online Source For Consumer Retail Health Opportunities

“Health comes to your local store,” explains the recently-launched portal, GoHealthEvents. This site is a one-stop shop for health consumers who are seeking health screenings and consults in local retail channels like big box stores, club stores, drug stores, and grocery stores. Events covered include cholesterol, diabetes, heart health, nutrition, osteoporosis, senior health, vaccinations and immunizations. By simply submitting a zip code, a health consumer seeking these kinds of services can identify where and when a local retailer will provide it. I searched on my own zip code in suburban Philadelphia, and found the following opportunities taking place in the

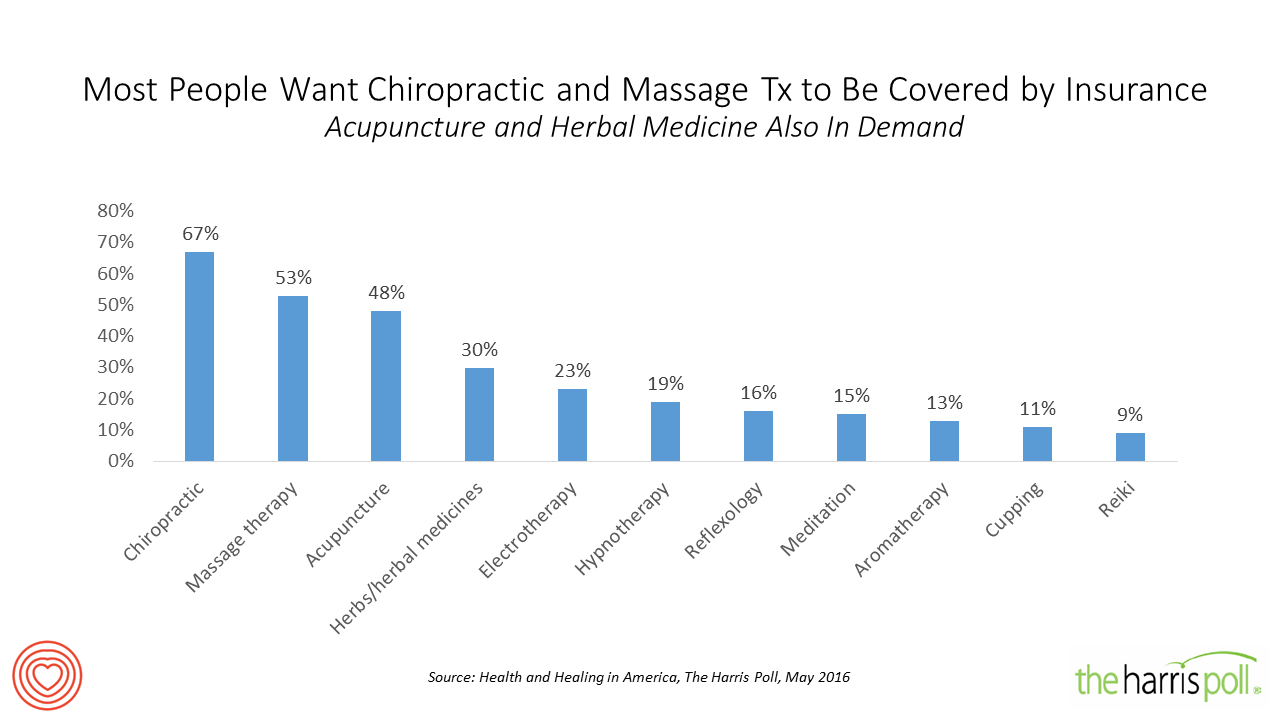

Finding Affordable Care In a Deductible World: The Growing Role of Alternative Therapies

Faced with the increasing financial responsibility for healthcare payments, and a desire to manage pain and disease via “natural” approaches, more U.S. consumers are seeking and paying for non-conventional or naturopathic therapies — complementary and alternative medicine (CAM). Health and Healing in America, The Harris Poll conducted among U.S. adults, learned that two in three Americans see alternative therapies as safe and effective. 1 in 2 people see alternative therapies as reliable. And most people believe that some of these treatments, like chiropractic and massage therapy, should be reimbursed by health insurance companies. Seven in 10 Americans have used alternative

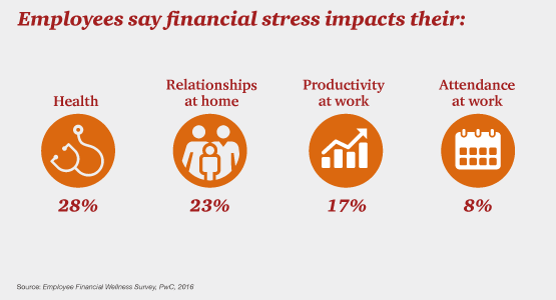

Money, Stress and Health: The American Worker’s Trifecta

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic. Some of the signs of the financial un-wellness malaise are that, in 2016: 40% of employees find it difficult to meet their household expenses on time each month 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers

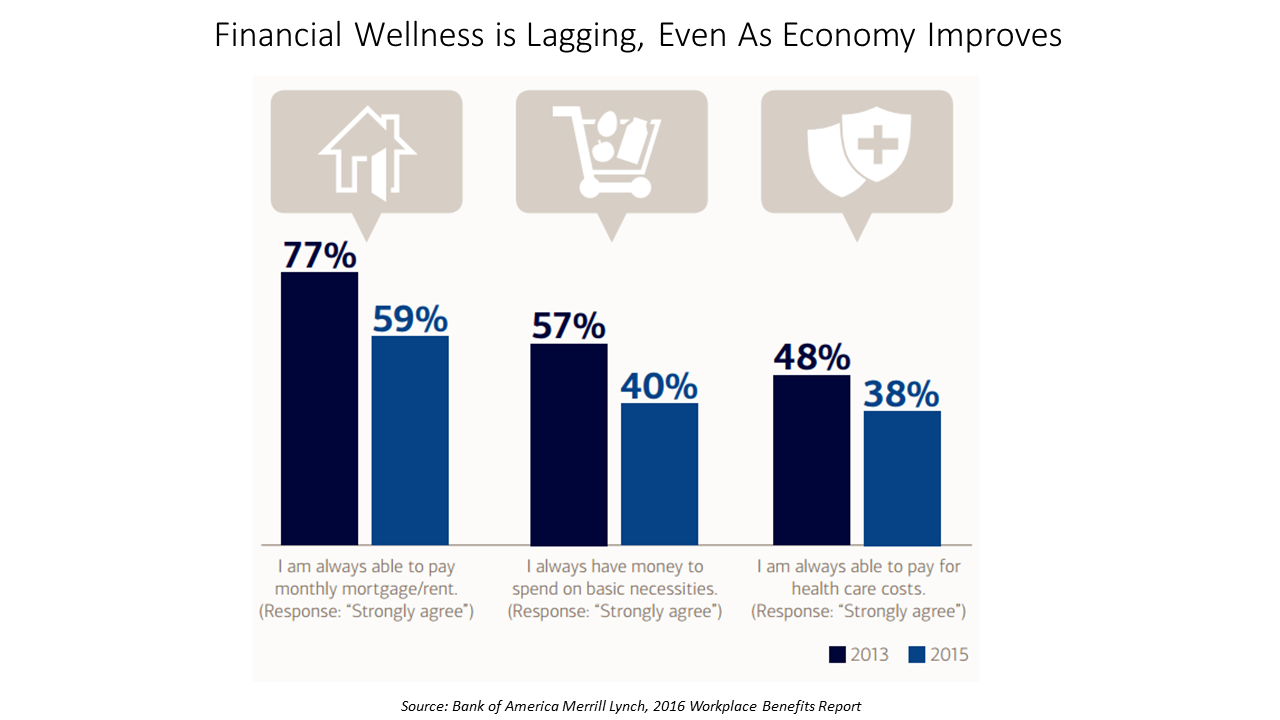

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

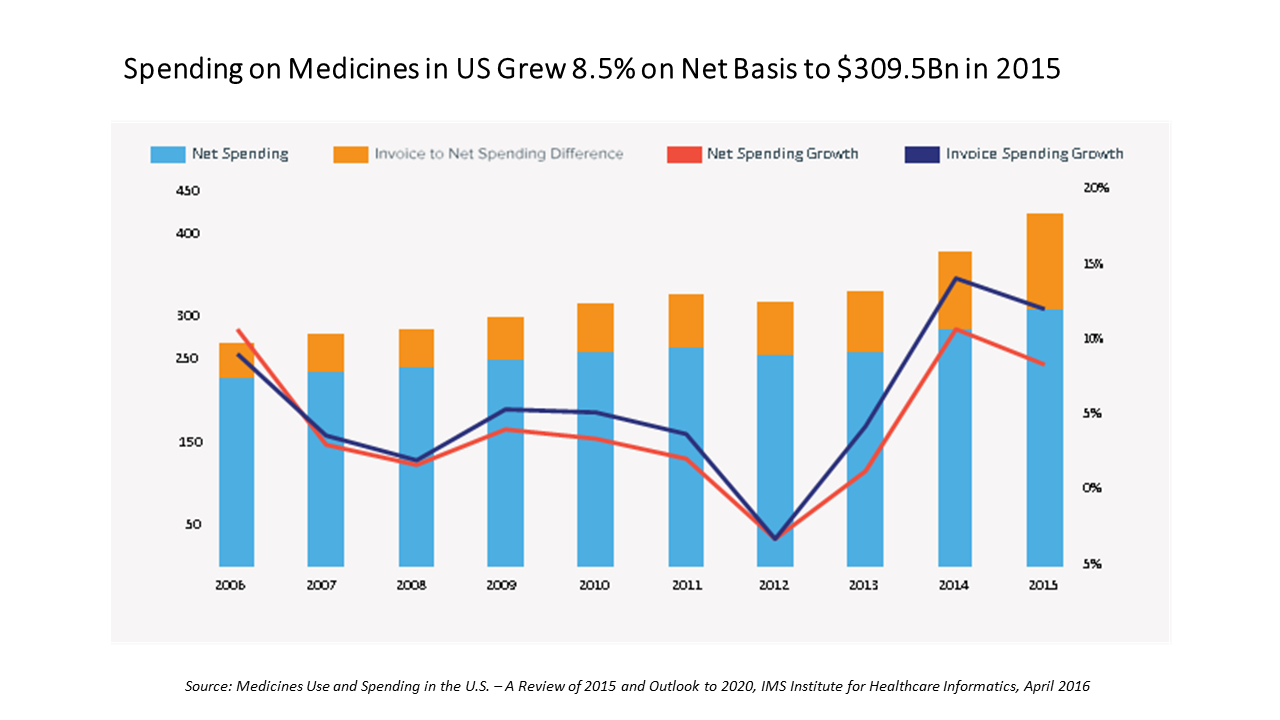

Expect Double-Digit Rx Cost Growth to 2020 – Implications for Oncology

In the U.S., spending on prescription medicines reached $425 bn in 2015, a 12% increase over 2014. For context, that Rx spending comprised about 14% of the American healthcare spend (based on roughly $3 trillion reported in the National Health Expenditure Accounts in 2014). We can expect double-digit prescription drug cost growth over the next five years, according to forecasts in Medicines Use and Spending in the U.S. – A Review of 2015 and Outlook to 2020 from IMS Institute of Healthcare Informatics. The biggest cost growth driver is specialty medicines, which accounted for $151 bn of the total Rx spend

Healthcare Vs New Entrants: A $1.5 T Problem

There’s an annual $1.5 trillion in revenues for the legacy healthcare system at stake by 2025, at risk of transferring to new entrants keen to please consumers, streamline physician practices, and provide new-new health insurance plans. A team from PwC has characterized this challenge in their strategy+business article, The Coming $1.5 Trillion Shift in Healthcare. Based on their survey of healthcare industry stakeholders and analyzing their economic model, the PwC team developed three scenarios about the 2025 healthcare market in the U.S. These are supply-driven, demand-driven, and equilibrium. The exhibit details each of these possible futures across various industry stakeholder

Cost Comes Before “My Doctor” In Picking Health Insurance

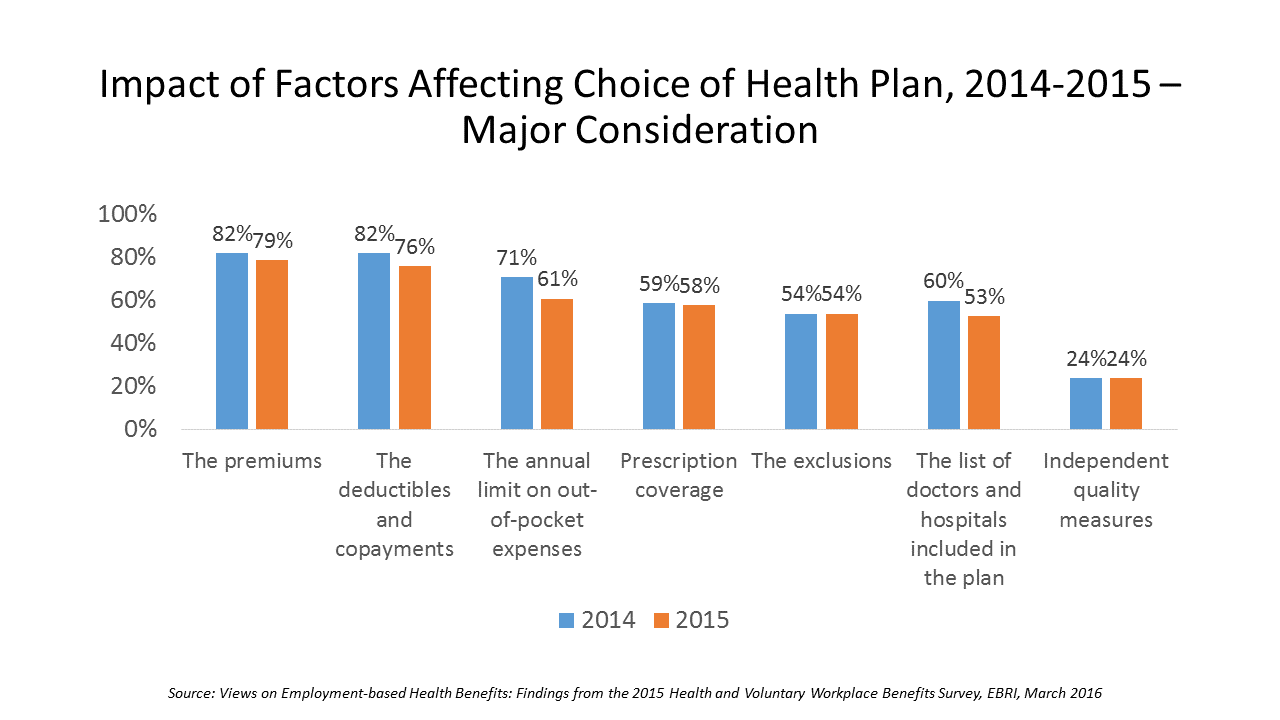

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

Consumers’ Growing Use of New Retail Health “Doors”

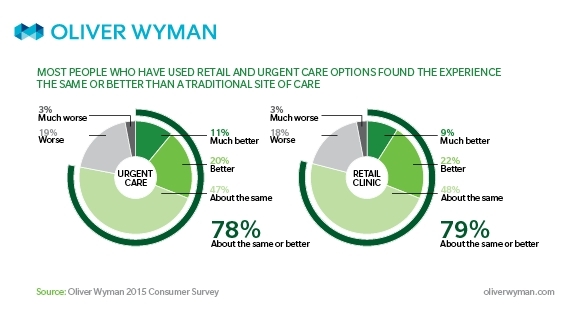

In the growing era of consumer-driven health, a growing list of options for receiving care are available to consumers. And people are liking new-new sites of care that are more convenient, cheaper, price-transparent, and digitally-enabled. Think of these new-new sites as “new front doors,” according to Oliver Wyman in their report, The New Front Door to Healthcare is Here. The traditional “doors” to primary and urgent care have been the doctor’s office, hospital ambulatory clinics, and the emergency room. Today, the growing locations for retail clinics and urgent care centers are giving consumers more visible and convenient choices for seeking

Behavioral Economics in Motion: UnitedHealthcare and Qualcomm

What do you get when one of the largest health insurance companies supports the development of a medical-grade activity tracker, enables data to flow through a HIPAA-compliant cloud, and nudges consumers to use the app by baking behavioral economics into the program? You get Motion from UnitedHealthcare, working with Qualcomm Life’s 2net cloud platform, a program announced today during the 2016 HIMSS conference. What’s most salient about this announcement in the context of HIMSS — a technology convention — is that these partners recognize the critical reality that for consumers and their healthcare, it’s not about the technology. It’s about

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

Telehealth Comes of Age at HIMSS 2016

Telehealth will be in the spotlight at HIMSS 2016, the biggest annual conference on health information technology (HIT) that kicks off on 29th February 2016 in Las Vegas – one of the few convention cities that can handle the anticipated crowd of over 50,000 attendees. Some major pre-HIMSS announcements relate to telehealth: American Well, one of the most mature telehealth vendors, is launching a software development kit (SDK) which will enable The new videoconferencing option can simultaneously connect patients with multiple physicians and specialists, and the SDK is designed to enable users to incorporate telemedicine consults into patient portals and

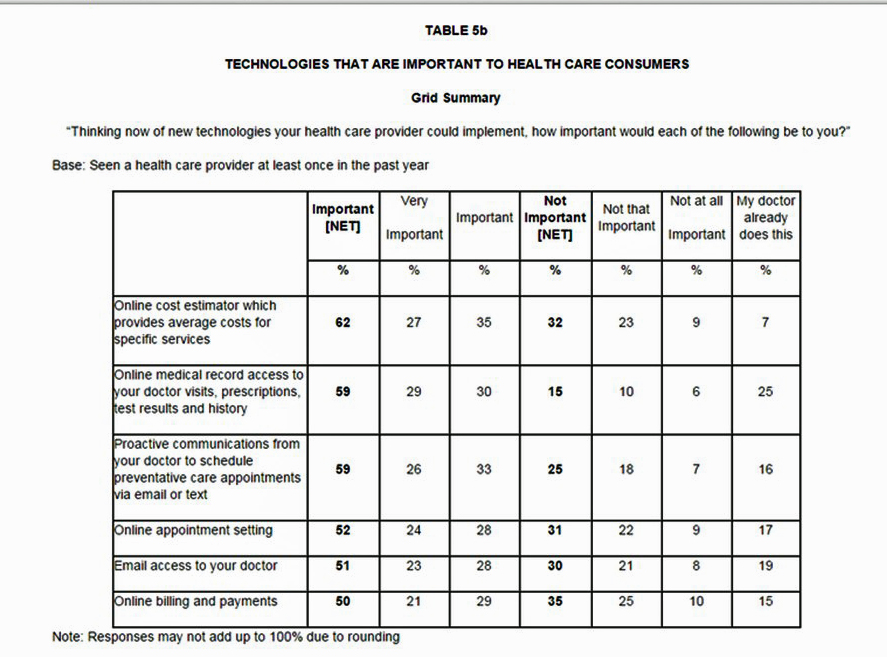

Health Consumers Happy With Doctor Visits, But Want More Technology Options

9 in 10 adults in the U.S. have visited a doctor’s office in the past year, and over half of these patients have been very satisfied with the visit; 35% have been “somewhat” satisfied. Being a highly-satisfied patient depends on how old you are: if you’re 70 or older, two-thirds of people are the most satisfied. Millennial or Gen X? Less than half. What underlies patient satisfaction across generations is the fact that younger people tend to compare their health care experience to other retail experiences, like visiting a bank, staying at a hotel, or shopping in a department store.

Getting Beyond Consumer Self-Rationing in High-Deductible Health Plans

The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute. “What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will

HealthcareDIY – from employee wellness incentives to #retailhealth, #pharmacy, & #CDHP

Most U.S. companies will increase the dollar value of health incentives offered to workers in 2012, based on the annual survey from Fidelity Investments and the National Business Group on Health addressing employers’ plans for health benefits. 3 in 4 employers used incentives in 2011 to engage employees in wellness programs, with an average incentive value of $460. This number was $260 in 2009. The poll found that employers expect employees to improve their personal health, and will increasingly ration access to benefits based on employees’ engagement with health criteria. Employers’ approaches to incentives have begun to adopt value-based benefit design strategies that

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.